Disney's daily revenue is a critical indicator of its financial health and market position, offering insights into the company's operational efficiency, global reach, and adaptability to changing consumer trends. As one of the world's most iconic entertainment giants, Disney's income streams span multiple sectors, including theme parks, media content, consumer products, and licensing. To understand the magnitude of its daily earnings, it is essential to break down these components and analyze their performance over recent years. For instance, during the fiscal year ending in October 2023, Disney reported a total revenue of approximately $83.9 billion, which translates to roughly $230 million per business day. However, this figure is not static and fluctuates based on seasonal demand, economic conditions, and strategic initiatives. The company's ability to maintain consistent revenue despite volatile markets underscores its strong brand equity and diversified business model.

One of the most significant contributors to Disney's revenue is its theme park division, which includes Magic Kingdom, Epcot, and other resorts across the United States and international locations such as Paris and Shanghai. Theme park income is highly seasonal, with peak periods during holidays like Christmas and summer breaks. For example, in 2023, the Walt Disney World Resort generated over $14 billion in annual revenue, driven by a combination of ticket sales, food and beverage expenditures, and merchandise purchases. Dividing this by 365 days yields an average of about $38 million per day, though actual figures can vary substantially. A single busy day at Disneyland, for instance, could see revenue surpass $100 million, while slower periods might result in earnings falling below $20 million. This volatility highlights the importance of demand forecasting and dynamic pricing strategies in managing the park's profitability.

The media and entertainment divisions, encompassing Disney's film studio, streaming services like Disney+, and TV networks, represent another major revenue source. In 2023, the company's media segment accounted for approximately $31 billion in annual revenue, with streaming subscriptions driving substantial growth. Disney+ reported over 192 million subscribers globally, contributing to a reported $3.9 billion in annual revenue from streaming services alone. Dividing this by 365 days gives roughly $10.7 million per day, but this figure is influenced by factors such as the release of blockbuster films, advertising revenue, and licensing deals. For example, the highly anticipated film Wish contributed over $135 million in its opening weekend, a significant portion of which would have been attributable to the media division during that period. Additionally, the company's international expansion, particularly in Asia and Latin America, has bolstered its streaming revenue, with markets like the Philippines and Mexico showing rapid adoption of Disney+ subscriptions.

Disney's consumer products and licensing division, which includes branded merchandise, clothing, and accessories, also plays a vital role in its revenue structure. This segment reported over $17 billion in annual revenue in 2023, with daily earnings ranging between $46,000 to $50,000. The division's performance is closely tied to the popularity of Disney's characters and franchises, which remain enduring staples in the global market. For instance, the success of the Star Wars and Marvel universes has driven consistent demand for licensed products, ensuring steady revenue streams. However, the decline in physical media sales and shifts in consumer preferences toward digital products have posed challenges, prompting Disney to invest heavily in e-commerce platforms and direct-to-consumer strategies.

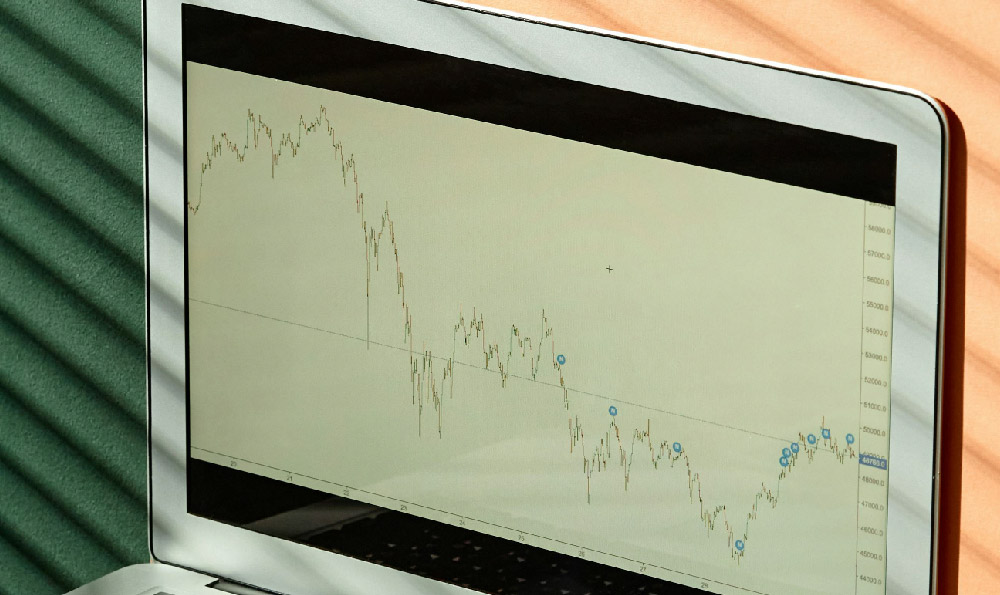

The company's stock performance is often influenced by its revenue trends, making daily earnings a key metric for investors. Disney's stock price has shown resilience over the past decade, with a Compound Annual Growth Rate (CAGR) of around 15% since 2015. However, investors should consider factors such as macroeconomic conditions, inflation, and the impact of geopolitical events on tourism and consumer spending. For example, during the global pandemic, Disney's stock faced significant declines due to reduced operating income from theme parks and theatrical releases. Conversely, as the company adapted to the post-pandemic environment by expanding its streaming offerings and optimizing its cost structure, its stock rebounded strongly.

When evaluating Disney's financial performance, it is also important to consider its debt levels and profit margins. As of 2023, Disney's debt stood at approximately $51.9 billion, which is manageable given its robust revenue streams and strong cash flow. The company's net profit margin has remained in the range of 12-15% over recent years, reflecting its ability to maintain profitability despite increasing operational costs. This financial discipline, combined with its strong brand and diversified business model, positions Disney as a reliable investment for those seeking long-term growth and stability.

For investors, Disney's daily revenue provides a clear picture of its ability to generate consistent income, which is essential for sustained shareholder value. However, it is equally important to analyze the broader economic context and market dynamics that influence its performance. Factors such as inflation, interest rates, and shifting consumer preferences can significantly impact Disney's revenue, making it a complex investment opportunity. Despite these challenges, Disney's history of innovation and adaptability suggests that it can continue to thrive in an evolving market, making it a compelling choice for those with a long-term investment horizon.

In summary, Disney's daily revenue is a multifaceted metric that reflects the company's strengths across various sectors. By understanding the nuances of its income streams and financial performance, investors can make informed decisions about whether to allocate capital to Disney's stock or other related investment products. While the company's revenue is subject to market fluctuations, its long-term growth potential remains strong, driven by a combination of traditional and digital business strategies. For those seeking financial stability and long-term returns, Disney's consistent revenue streams and robust brand make it an attractive investment opportunity.