Cryptocurrency investment has emerged as one of the most dynamic avenues for generating online income, offering both opportunities and complexities that demand strategic acumen. The digital asset market, though volatile, is underpinned by factors such as technological innovation, macroeconomic trends, and regulatory developments, which collectively shape its trajectory. For those willing to approach this domain with analytical rigor and prudence, the potential for profit can be substantial, but the risks are equally formidable. To navigate this landscape effectively, it is essential to not only grasp the fundamentals of market behavior but also to cultivate a mindset that prioritizes long-term growth over short-term gains.

The cryptocurrency market is inherently influenced by global events, from Bitcoin's price fluctuations driven by interest rate changes to Ethereum's evolution as a smart contract platform. In recent years, the rise of decentralized finance (DeFi) protocols has further diversified investment options, enabling users to earn interest through staking or liquidity provision. Similarly, the emergence of non-fungible tokens (NFTs) has created new avenues for creative income, though their speculative nature requires careful evaluation. Understanding these dynamics necessitates a continuous learning process, as the interplay between technology, demand, and supply creates unique scenarios. For instance, the adoption of blockchain technology in sectors like supply chain management or healthcare has indirectly driven institutional interest in cryptocurrencies, leading to broader market participation.

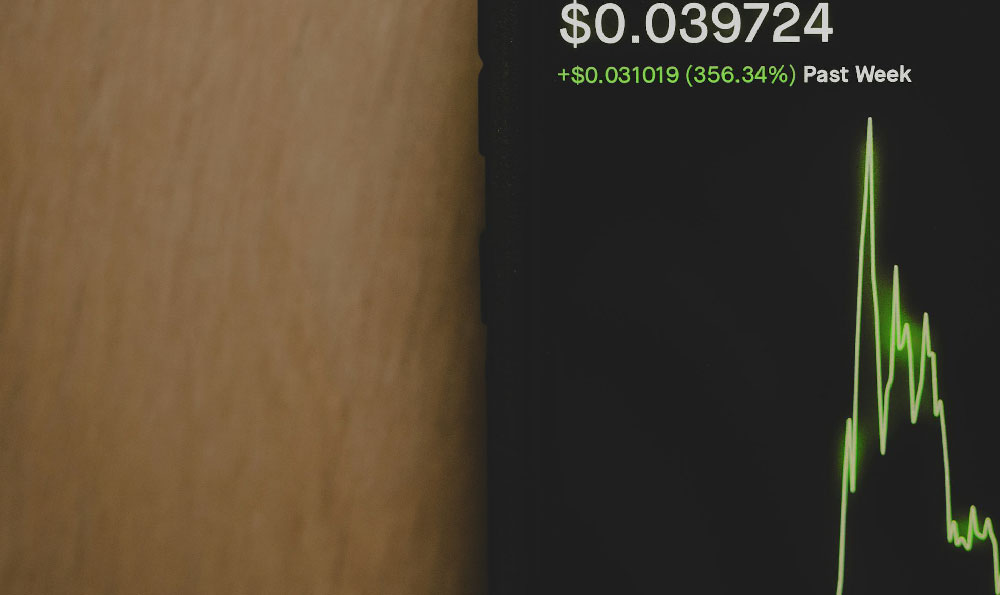

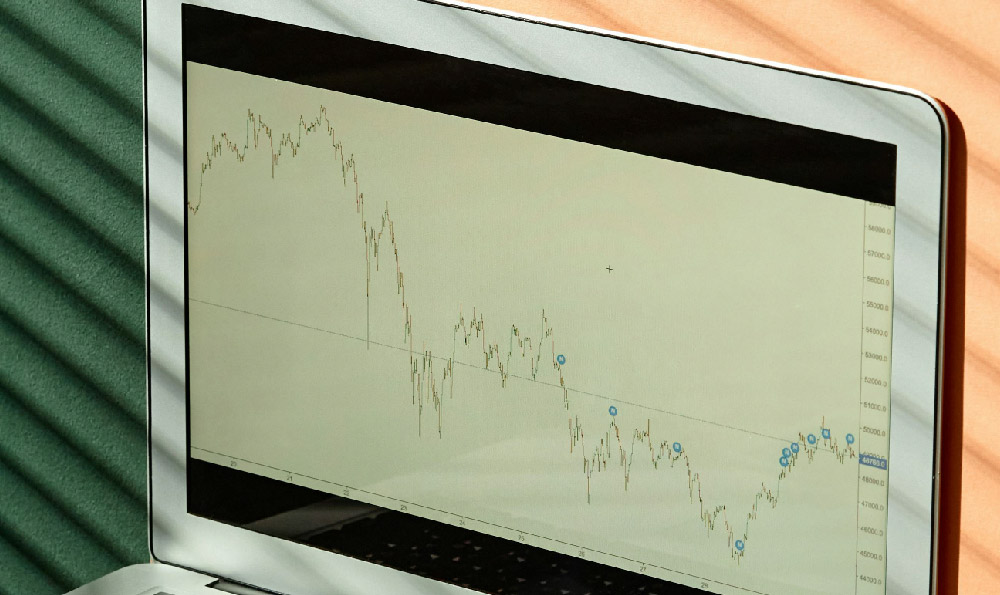

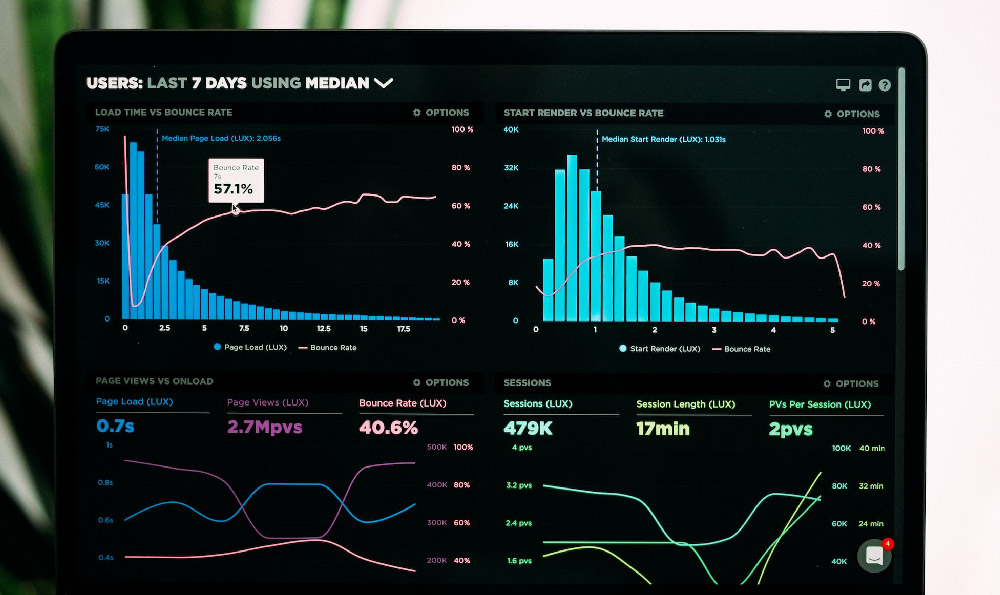

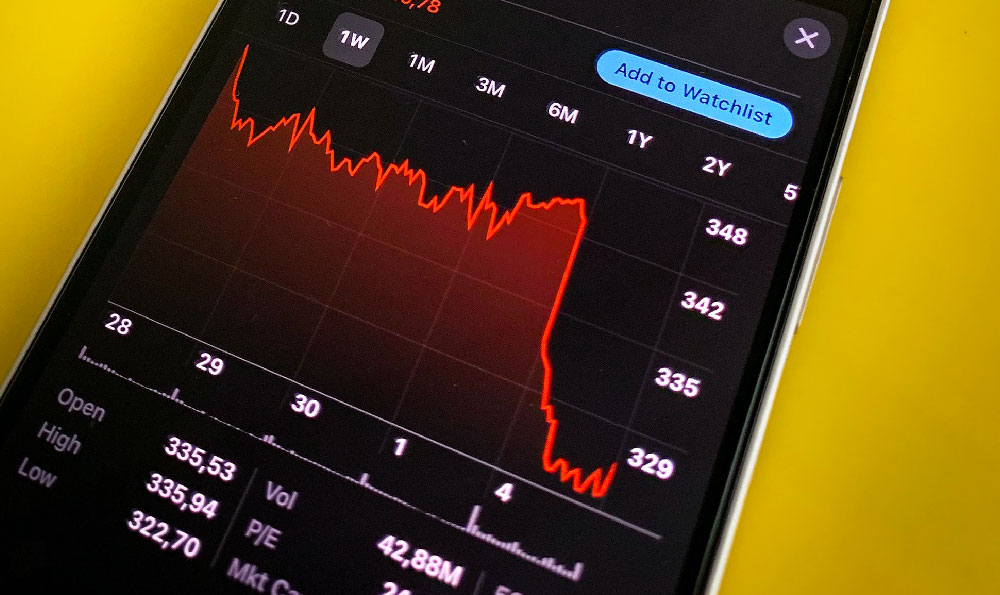

Technical analysis serves as a cornerstone for making informed decisions in cryptocurrency trading. By studying historical price data and volume patterns, investors can identify potential trends and entry points. Tools such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are commonly used to gauge market sentiment and momentum. For example, a rising RSI above 70 often signals overbought conditions, while a MACD crossover can indicate bullish or bearish signals. However, these indicators should not be viewed in isolation; they require contextual interpretation. A trader might analyze a cryptocurrency's support and resistance levels in conjunction with news cycles, such as major partnership announcements or regulatory decisions, to refine their strategy. Additionally, volume analysis can reveal the strength of a price move—sustained buying activity during a rally often suggests institutional involvement, whereas declining volume during a rise may indicate weakness.

Effective investment strategies in the crypto space require a blend of patience, education, and disciplined execution. The concept of "hodling" or long-term holding has proven successful for many, particularly in the case of Bitcoin, which has demonstrated resilience amid market downturns. Conversely, day trading or swing trading can yield rapid returns but demands meticulous monitoring of market conditions. A balanced approach often involves allocating a portion of one's portfolio to long-term assets while using derivatives or altcoins for short-term opportunities. For instance, a trader might hold a significant amount of Bitcoin while using futures contracts to capitalize on short-term volatility in altcoins like Solana or Cardano. Furthermore, leveraging compound interest through staking or yield farming has allowed investors to generate passive income, though the associated risks of network congestion or smart contract vulnerabilities must be weighed.

Risk management is paramount in any investment endeavor, and cryptocurrency is no exception. The market's inherent unpredictability is exacerbated by factors such as regulatory uncertainty, market manipulation, and technological risks. To mitigate these, investors should adopt a diversified approach, spreading their capital across multiple assets rather than focusing on a single cryptocurrency. Position sizing is also critical—allocating no more than 5-10% of one's portfolio to any single asset reduces potential losses. Additionally, setting clear stop-loss orders based on technical levels or fundamental analysis can protect capital during sudden downturns. For example, a trader might exit a long position if the price drops below a key support level identified through historical data or if a major regulatory event occurs. Staying updated on news cycles, such as SEC rulings or central bank interventions, enables timely adjustments to one's strategy.

The allure of quick earnings in the cryptocurrency market often leads investors to overlook the importance of compliance and security. Popular scams, including phishing attacks, fake initial coin offerings (ICOs), and rug pulls, exploit the lack of oversight in certain segments. To avoid these pitfalls, investors should conduct thorough due diligence on projects, verifying whitepapers, team credentials, and community engagement. Reputable exchanges and wallets that employ advanced security protocols, such as two-factor authentication (2FA) and cold storage, can safeguard digital assets. Moreover, the practice of "dark mode" or using anonymous transactions in certain protocols, like privacy-focused coins, can enhance security against potential breaches. However, anonymity also comes with trade-offs, such as challenges in verifying project legitimacy or complying with anti-money laundering (AML) regulations.

Beyond technical and strategic considerations, emotional discipline plays a crucial role in cryptocurrency investing. Fear and greed often drive impulsive decisions, such as panic selling during a market correction or buying at peak prices. A successful trader cultivates a mindset of patience, waiting for well-defined signals before entering or exiting positions. This includes setting realistic goals, avoiding overtrading, and maintaining a psychological distance from short-term price movements. For example, a trader might focus on long-term value appreciation for Bitcoin while using short-term tactics for smaller-cap tokens, ensuring that emotional triggers do not dictate their actions.

Ultimately, generating income through cryptocurrency requires a holistic approach that combines market understanding, technical proficiency, strategic diversification, and stringent risk management. While the potential for profit is undeniable, the absence of guaranteed returns necessitates a commitment to continuous learning and adaptability. By staying informed about technological advancements, regulatory changes, and market psychology, investors can position themselves to not only achieve financial growth but also preserve their capital in an environment that is as rewarding as it is volatile. The key lies in balancing ambition with caution, ensuring that every decision is rooted in thorough analysis and a well-defined plan.