In the realm of digital currencies and investment, the pursuit of financial growth often hinges on understanding both the volatile nature of the market and the strategic frameworks that can mitigate risks while capitalizing on opportunities. Whether you're navigating the complexities of cryptocurrency trading or seeking to diversify your investment portfolio, a disciplined approach is essential. The key lies in balancing technical analysis with psychological resilience, ensuring that your decisions are grounded in data rather than speculation. Here's a comprehensive exploration of how to effectively harness these tools to generate sustainable returns.

The foundation of any successful investment strategy begins with a clear understanding of the assets you're engaging with. Virtual currencies, such as Bitcoin, Ethereum, or altcoins, operate on decentralized networks and are subject to rapid price fluctuations. However, these fluctuations are not random; they are often driven by supply and demand dynamics, regulatory changes, technological advancements, and macroeconomic factors. By staying informed about these underlying forces, investors can make more calculated moves. For instance, monitoring blockchain activity for signs of network upgrades or increased adoption can signal potential growth, while tracking market sentiment through news cycles and social media trends can highlight risks of a sudden downturn.

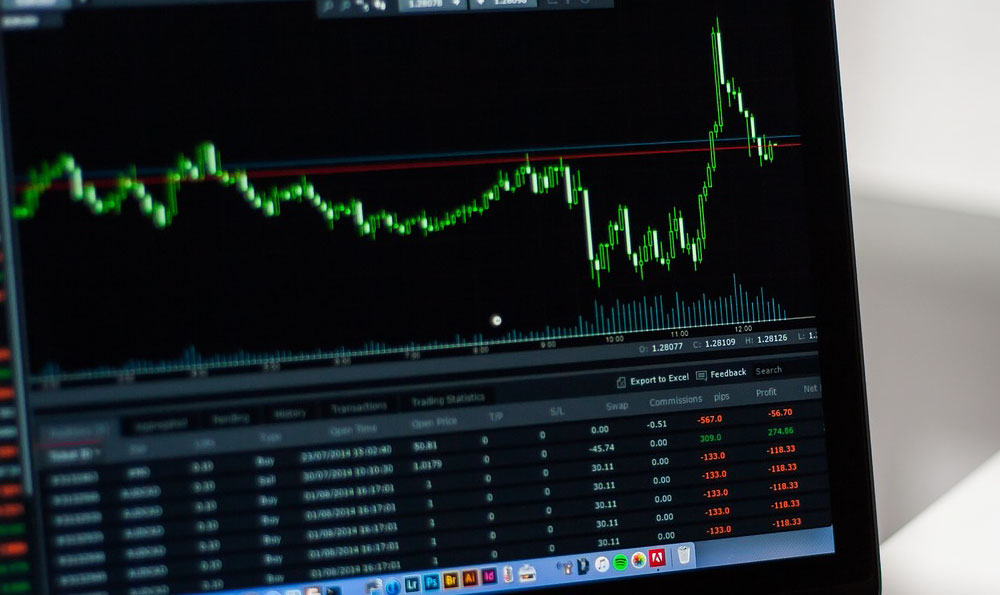

Profitability in the crypto market frequently stems from a combination of short-term trading and long-term holding. Short-term traders often rely on technical indicators like moving averages, RSI (Relative Strength Index), and Fibonacci retracements to identify entry and exit points. These tools help visualize price trends and potential support/resistance levels, enabling traders to time their transactions more effectively. For example, a 50-day moving average crossing above a 200-day moving average—a bullish signal—might prompt a trader to initiate a long position. Conversely, a high RSI reading (typically above 70) could indicate an overbought condition, suggesting a sell-off might be imminent. Yet, technical analysis is not foolproof, and it’s crucial to complement it with fundamental research, such as evaluating a project's team, roadmap, and real-world utility.

Beyond the technical and fundamental aspects, risk management remains the cornerstone of long-term success. Exposure to high-risk assets without proper safeguards can lead to significant losses, especially in a market characterized by extreme volatility. One of the most effective risk management practices is to diversify your holdings across different cryptocurrencies and sectors. For instance, allocating funds to both blue-chip assets like Bitcoin and emerging projects in DeFi (Decentralized Finance) or NFTs (Non-Fungible Tokens) can reduce the impact of a single asset's underperformance. Additionally, setting stop-loss orders and taking profits at predetermined levels can protect your capital from sharp market corrections.

The art of investing also lies in managing expectations. The crypto market is prone to hype cycles, where prices surge rapidly due to speculative buying, only to experience a dramatic crash when momentum wanes. During the bull phase, it's easy to get carried away by the potential for exponential gains, but this often leads to poor decision-making. Conversely, during the bear phase, impatience can drive investors to sell at a loss. To avoid these pitfalls, maintaining a long-term perspective is vital. Focus on the intrinsic value of assets, their adoption rates, and the broader trends in the blockchain industry, rather than fleeting market movements.

Another critical dimension is the role of automation and algorithmic trading in streamlining the investment process. Trading bots, for example, can execute trades based on predefined criteria, such as price thresholds or volume spikes, allowing investors to maintain consistency without emotional interference. However, automation should not replace human oversight. While bots can analyze data rapidly, they lack the contextual understanding to interpret macroeconomic shifts or regulatory surprises. A hybrid approach—leveraging the speed of algorithms while relying on human judgment for higher-level decisions—can create a balanced strategy.

To further enhance your investment outcomes, it's beneficial to stay updated on the regulatory landscape and technological innovations. Governments worldwide are increasingly scrutinizing cryptocurrencies, and changes in laws can significantly impact market dynamics. For example, the introduction of favorable regulations might boost institutional adoption, while restrictive policies could lead to market consolidation. Similarly, advancements in blockchain technology, such as the development of layer-two solutions or cross-chain interoperability, can drive long-term value for certain tokens. Keeping abreast of these developments ensures that your investment decisions align with the evolving ecosystem.

Moreover, the importance of time allocation in investing cannot be overstated. While it's tempting to chase quick wins, sustained growth requires patience and adherence to a well-defined strategy. For instance, a long-term investor might take months or even years to benefit from a gradual price increase, whereas a short-term trader could achieve returns within days. However, the latter approach necessitates constant monitoring and rapid execution, which can be mentally taxing. Aligning your investment style with your risk tolerance and available time is crucial to maintaining consistency.

In conclusion, generating returns in the world of virtual currencies demands a blend of technical expertise, fundamental insight, and strategic discipline. By analyzing market trends, leveraging tools for decision-making, and prioritizing risk management, investors can navigate the complexities of this dynamic landscape with confidence. Remember, the path to financial growth is rarely linear, and success often comes from adaptability, patience, and a deep understanding of the forces at play. As you embark on your investment journey, let your knowledge guide your choices, and always remain cautious of the potential for market volatility.