The allure of quick money in the volatile world of cryptocurrency is undeniable. Images of overnight millionaires plastered across social media fuel this desire, beckoning newcomers with promises of rapid riches. However, the reality of achieving significant financial gains quickly through crypto investing is far more nuanced and fraught with risk than these portrayals suggest. Understanding this dichotomy is crucial before venturing into the space.

The possibility of making quick money in crypto definitely exists, but it's important to recognize that it's more akin to gambling than traditional investing. Certain scenarios lend themselves to potentially rapid gains. For example, identifying and investing in promising new projects early on, before they are widely known, could yield significant returns if the project gains traction and its token value increases substantially. Similarly, capitalizing on short-term market fluctuations through day trading or swing trading can be lucrative, provided one possesses the technical skills and emotional discipline required to execute trades effectively. Furthermore, participating in Initial Coin Offerings (ICOs) or Initial DEX Offerings (IDOs) might present opportunities for quick gains, but these are generally associated with very high risk as many such projects may fail.

However, pursuing quick money in crypto comes with a multitude of dangers. The volatility inherent in the market means prices can swing wildly and unexpectedly. A token that skyrockets today can plummet just as dramatically tomorrow. This volatility makes it incredibly challenging to predict market movements accurately and consistently, even for seasoned traders.

Attempting to time the market, a common strategy for those seeking quick returns, is notoriously difficult. Countless investors have lost substantial amounts of money trying to predict market tops and bottoms. The fear of missing out (FOMO) can lead to impulsive decisions, buying high and selling low, a classic pitfall for inexperienced investors. Emotions like greed and fear can cloud judgment and lead to irrational behavior.

Another significant risk is the prevalence of scams and fraudulent projects in the crypto space. Pump-and-dump schemes, where promoters artificially inflate the price of a token before dumping their holdings and leaving other investors with significant losses, are rampant. Projects with vague or unrealistic promises, lacking a solid foundation or a credible team, are also common red flags.

So, how can one navigate this landscape and potentially achieve quick returns while mitigating risk? The first and most important step is education. A deep understanding of the underlying technology, market dynamics, and risk factors is essential. This involves researching different cryptocurrencies, understanding blockchain technology, and learning how to analyze market trends. Reputable online courses, books, and investment communities can provide valuable knowledge and insights.

Secondly, develop a well-defined investment strategy. This strategy should outline your investment goals, risk tolerance, and time horizon. It should also include specific rules for buying and selling, such as setting stop-loss orders to limit potential losses. A clear strategy helps to avoid emotional decision-making and stay disciplined.

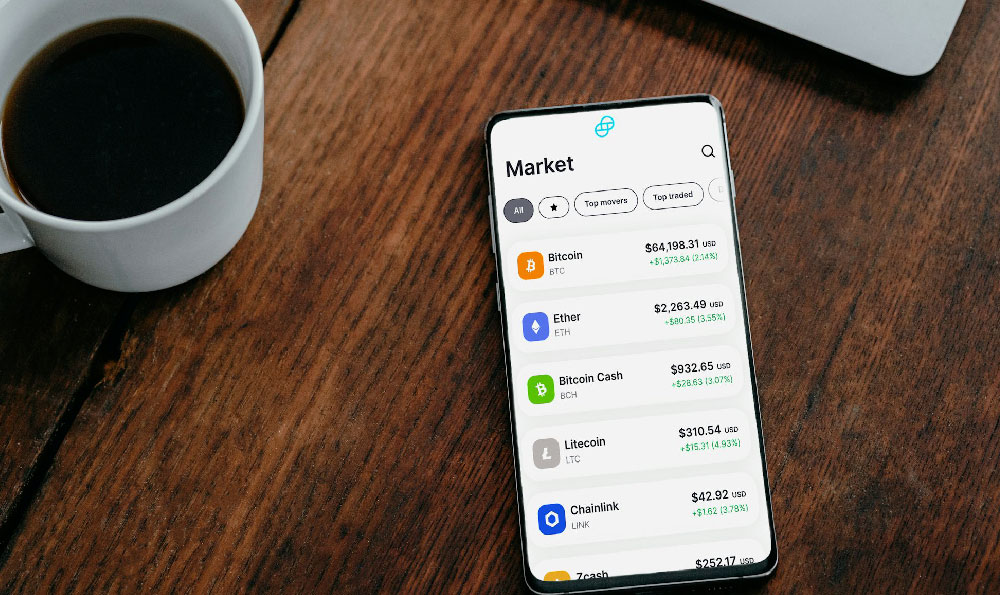

Third, diversify your portfolio. Do not put all your eggs in one basket. Spreading your investments across multiple cryptocurrencies reduces the impact of any single investment performing poorly. Consider diversifying across different types of cryptocurrencies, such as established coins like Bitcoin and Ethereum, as well as smaller, more speculative altcoins.

Fourth, only invest what you can afford to lose. This is a crucial principle in any form of investment, but especially important in the high-risk world of crypto. Never invest money that you need for essential expenses, such as rent, food, or healthcare.

Fifth, conduct thorough due diligence before investing in any project. Research the team behind the project, their track record, and their vision. Read the whitepaper carefully and understand the underlying technology and use case. Look for red flags, such as unrealistic promises, a lack of transparency, or a history of questionable behavior.

Sixth, be wary of hype and FOMO. Just because a cryptocurrency is trending on social media or being promoted by influencers doesn't mean it's a good investment. Do your own research and make your own informed decisions.

Seventh, use reputable exchanges and wallets. Choose exchanges with strong security measures and a good track record. Store your cryptocurrencies in a secure wallet that you control, rather than leaving them on an exchange. Consider using a hardware wallet, which is a physical device that stores your private keys offline, providing an extra layer of security.

Eighth, stay informed and adapt to changing market conditions. The crypto market is constantly evolving, so it's important to stay up-to-date on the latest news, trends, and developments. Be prepared to adjust your investment strategy as needed.

Finally, consider seeking advice from a qualified financial advisor. A financial advisor can help you assess your risk tolerance, develop a personalized investment plan, and navigate the complexities of the crypto market.

In conclusion, while the possibility of making quick money in crypto exists, it's crucial to approach it with caution and a realistic understanding of the risks involved. Education, a well-defined investment strategy, diversification, and due diligence are essential for mitigating risk and increasing the chances of success. Remember that quick money often comes with high risk, and it's far more prudent to focus on long-term, sustainable growth rather than chasing fleeting opportunities for rapid riches. The crypto market is a marathon, not a sprint.