Financial management skills

-

Investing Retirement Money: Where and How?

Investing retirement funds in crypto? Learn the strategic approach to integrating cryptocurrencies into your retirement portfolio. Understand risk management, diversification (stocks, bonds, real estate), and appropriate crypto allocation (5% or less). Discover how to choose established cryptocurrencies like Bitcoin and Ethereum, conduct due diligence on altcoins, and secure your assets with hardware wallets. Explore dollar-cost averaging (DCA), tax implications, and DeFi risks. Get tips on monitoring, rebalancing, and long-term planning for digital assets in retirement. Grow your nest egg while mitigating risk.

Learn more2025-05 07 -

Morgan Stanley Investing: Where to Start & Is It Right for You?

Considering Morgan Stanley for wealth management? Understand their tiered services, from E*TRADE for self-directed investors to personalized financial advisors for high-net-worth individuals. Explore minimum investment requirements, fee structures, and the importance of aligning your investment experience, financial goals, and risk tolerance. Learn if Morgan Stanley's extensive resources and comprehensive planning are the right fit for your unique needs and aspirations. Discover their Private Wealth Management division and bespoke solutions. Compare options, understand fees, and choose a partner who truly understands your financial aspirations.

Learn more2025-05 07 -

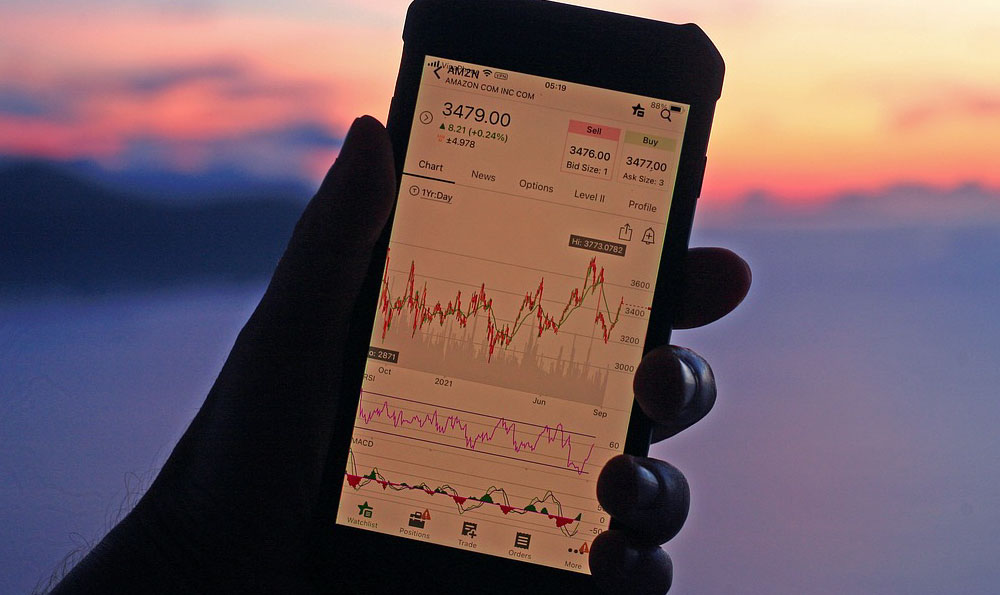

Investing in Stocks: Where to Begin and How to Succeed?

Investing in the stock market can be rewarding. Learn the basics, build a sound strategy, and manage risk effectively. This guide covers stock types, financial statements, goal setting, and active vs. passive investing. Discover diversification techniques, choosing a brokerage, and researching companies. Stay disciplined, avoid impulsive decisions, and view downturns as opportunities. Long-term success requires knowledge, patience, and potentially professional financial advice.

Learn more2025-05 07 -

Investing in SpaceX: What are the options, and is it possible?

Investing in SpaceX, a leader in space exploration, isn't straightforward. This article explores ways to potentially gain indirect exposure to this innovative company, from investing in its parent company (X Holdings Corp.) or identifying publicly traded partners and suppliers to participating in secondary markets (high risk) and venture capital funds focused on space technology. We also discuss the potential for a SpaceX IPO and the factors influencing that decision. Understand the challenges, risks, and potential rewards before investing in this groundbreaking enterprise or related space ventures. Learn about alternative investment strategies and future options.

Learn more2025-05 07 -

Wine Investment: Worth it? How to Start?

Is wine investment worth it? Explore the world of wine investing: understand the merits, challenges & practical steps. From Bordeaux to Burgundy, discover how scarcity, vintage quality, & critic scores impact wine values. Learn about storage, risks like counterfeit wine, & building a diversified portfolio. Discover the returns, what you need to know before you uncork your investment aspirations. Invest in education, build connections and storage, before diving in. Find out if wine investment suits your goals and risk tolerance and you could unlock the potential for financial returns.

Learn more2025-05 07 -

Web3 Investing: What & How?

Explore Web3 investing: a guide to understanding cryptocurrencies, NFTs, DeFi, and venture capital in the decentralized internet. Navigate the complexities and risks of Web3 with our strategic approach. Learn how to research projects, manage risk, and diversify your portfolio for long-term success. Discover the importance of regulatory awareness and security practices in the evolving Web3 landscape. Get insights into Bitcoin, Ethereum, altcoins, decentralized finance protocols, and Web3 startups. Seek professional advice and stay informed to make smart investment decisions in this dynamic digital economy.

Learn more2025-05 07 -

Investing in the S&P 500: What's the Process, and Is It Right for You?

Learn how to invest in the S&P 500 index! Understand ETFs, index funds, dollar-cost averaging (DCA), and how to build a diversified portfolio. This guide covers everything from brokerage accounts to risk tolerance, helping you decide if S&P 500 investing aligns with your financial goals. Discover the benefits and potential risks, explore investment strategies, and make informed decisions for long-term wealth building. Find the right approach to S&P 500 investing to achieve your objectives.

Learn more2025-05 07 -

Investing in the S&P 500 Index: How and Where?

Learn how to invest in the S&P 500 index! This guide covers everything from understanding the S&P 500 and its advantages to choosing the right investment vehicles like index funds and ETFs. Discover the benefits of low expense ratios and diversification. We'll explore where to buy these funds (brokerage accounts, 401(k)s, and IRAs), the importance of dollar-cost averaging, and strategies for diversifying beyond the S&P 500. Understand market risk, adjust your asset allocation, and stay informed about economic factors. Start building a well-rounded investment portfolio today!

Learn more2025-05 07 -

Cash App Stocks: Investing Guide or Risky Gamble?

Is investing in stocks through Cash App a smart move or a risky gamble? This article explores the factors that distinguish informed investing from reckless speculation on platforms like Cash App. We delve into the importance of research, understanding risk tolerance, and developing a long-term investment strategy. Discover how fractional shares, diversification, and educational resources can impact your investment outcomes. Learn to avoid common pitfalls like emotional trading, FOMO, and potential scams. Uncover the key to transforming your Cash App stock experience from a potentially high-stakes gamble into a calculated and informed investment strategy for long-term wealth building.

Learn more2025-05 07 -

SoftBank Investing: What & How?

Explore SoftBank's investment strategy and its impact on the tech industry. This analysis delves into their high-risk, high-reward philosophy, the role of the Vision Fund in shaping AI, robotics, and IoT, and their diverse portfolio, including Uber, Alibaba, and more. Learn about their "blitzscaling" approach, investment process driven by data and intuition, and the active involvement in portfolio companies. Understand SoftBank's influence on innovation, valuations, and the global economy, examining both successes and failures like WeWork. Discover the key takeaways for investors, entrepreneurs, and policymakers navigating the evolving tech landscape.

Learn more2025-05 07