Okay, I understand. Here's an article addressing the question of Bitcoin investment, focusing on the amount to invest and its potential for profitability, while aiming for a comprehensive and engaging approach without overly structured formatting.

Navigating the Bitcoin Maze: Investment Amounts and Profitability Potential

Bitcoin, the digital gold of the 21st century, has captivated investors and skeptics alike. The promise of decentralized finance, coupled with stories of overnight millionaires, has drawn countless individuals into the cryptocurrency realm. However, before diving headfirst into the Bitcoin pool, it's crucial to address the burning questions: how much Bitcoin should one invest, and can it actually lead to financial gain?

The answer, as with most investment decisions, is far from straightforward and depends heavily on individual circumstances and risk tolerance. There's no magic number that guarantees riches, and approaching Bitcoin investment with a get-rich-quick mentality is a recipe for potential disappointment. Instead, a measured and informed approach is paramount.

One foundational principle to consider is the concept of portfolio diversification. Placing all your eggs in the Bitcoin basket is akin to betting your entire future on a single roll of the dice. Financial advisors universally recommend spreading investments across various asset classes, such as stocks, bonds, real estate, and commodities. Within this diversified framework, Bitcoin can represent a smaller, potentially high-growth, but also high-risk, component.

To determine the appropriate allocation, honestly assess your risk appetite. Are you comfortable with significant price swings? Can you stomach the possibility of losing a substantial portion of your investment? If the thought of Bitcoin's volatility keeps you up at night, a smaller allocation is advisable. A general guideline for beginners might be to allocate no more than 1% to 5% of their overall investment portfolio to Bitcoin. This allows you to participate in the potential upside while mitigating the impact of any potential downturn.

Another crucial factor is your financial situation. Before even considering Bitcoin, ensure you have a solid financial foundation. This includes having an emergency fund that covers 3-6 months of living expenses, paying off high-interest debt, and contributing to retirement accounts. Bitcoin investment should be viewed as supplemental to, not a replacement for, these fundamental financial pillars. Investing money you can't afford to lose is a cardinal sin in the world of finance.

Beyond personal considerations, understanding Bitcoin itself is essential. Don't simply jump on the bandwagon because you heard a friend made a fortune. Research the underlying technology, the factors driving its price fluctuations, and the regulatory landscape surrounding cryptocurrencies. Knowledge is your best defense against scams and poorly informed investment decisions.

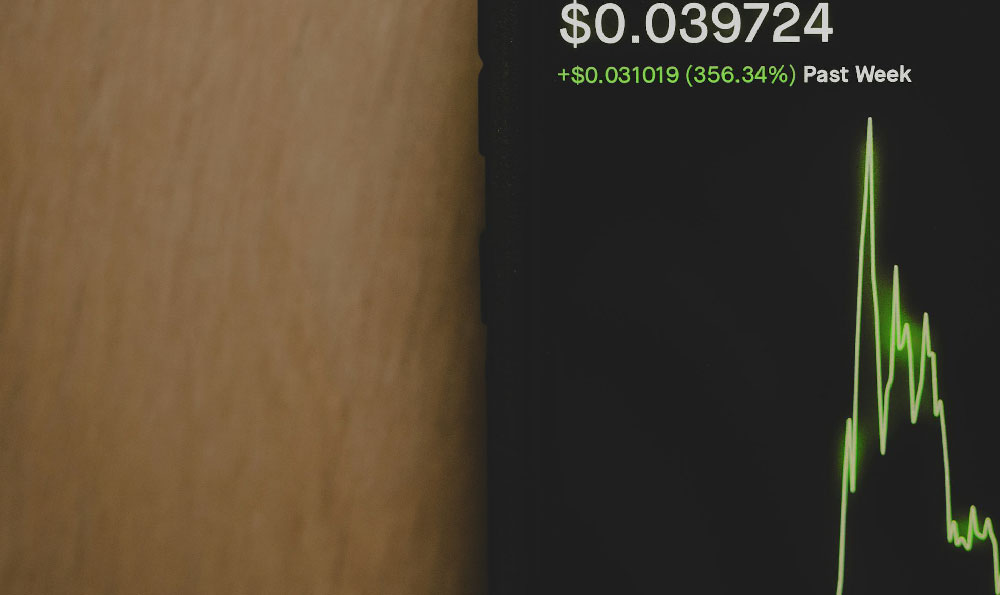

The potential for Bitcoin to generate profits is undeniable, but it's not a guaranteed outcome. Bitcoin's price has historically been incredibly volatile, experiencing periods of explosive growth followed by significant corrections. These fluctuations are influenced by a complex interplay of factors, including supply and demand, regulatory developments, technological advancements, and macroeconomic trends.

Those who invested in Bitcoin early and held on have undoubtedly reaped substantial rewards. However, past performance is not indicative of future results. While some analysts predict Bitcoin will reach astronomical heights, others foresee a dramatic decline. The truth likely lies somewhere in between, and predicting Bitcoin's future price with certainty is impossible.

Instead of trying to time the market, consider a dollar-cost averaging strategy. This involves investing a fixed amount of money in Bitcoin at regular intervals, regardless of the current price. Over time, this approach can help you smooth out the volatility and potentially lower your average cost per Bitcoin. It also removes the emotional element of trying to buy low and sell high, which often leads to poor investment decisions.

Moreover, consider your investment timeframe. Bitcoin is generally considered a long-term investment. Short-term trading can be incredibly risky and requires a deep understanding of technical analysis and market psychology. If you're looking for a quick profit, Bitcoin is likely not the right choice.

Furthermore, be aware of the associated costs. Buying and selling Bitcoin involves transaction fees, and some exchanges may charge additional fees for withdrawals or other services. These fees can eat into your profits, especially if you're frequently trading small amounts.

Finally, remember that the regulatory landscape surrounding Bitcoin is constantly evolving. Governments around the world are grappling with how to regulate cryptocurrencies, and new regulations could have a significant impact on Bitcoin's price and adoption. Stay informed about these developments and be prepared to adapt your investment strategy accordingly.

In conclusion, determining the appropriate amount of Bitcoin to invest is a personal decision that requires careful consideration of your risk tolerance, financial situation, and investment goals. Treat Bitcoin as a small, potentially high-growth component of a diversified portfolio, and always prioritize a solid financial foundation. While the potential for profit exists, it's not guaranteed, and understanding the underlying technology, market dynamics, and regulatory landscape is crucial for making informed investment decisions. Approach Bitcoin investment with a measured and informed perspective, and be prepared for the volatility that comes with it. Remember, it's not about getting rich quick; it's about building a secure financial future over the long term.