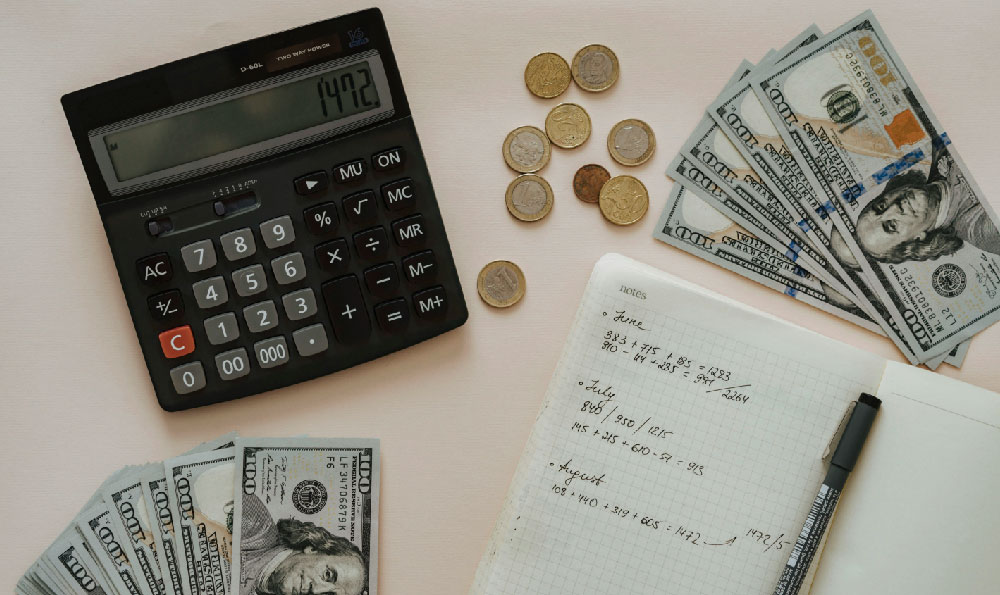

The period between jobs can be stressful, especially when financial stability is at stake. However, with careful planning and a proactive approach, it's possible to generate income and even grow your wealth during this transition. Exploring various income-generating avenues, from leveraging existing skills to venturing into the world of cryptocurrency investment, can provide a much-needed financial cushion.

One of the most straightforward approaches is to tap into the gig economy. Platforms offering freelance services, such as writing, editing, graphic design, web development, and virtual assistance, can provide immediate opportunities. Many businesses and individuals are constantly seeking skilled professionals for short-term projects, and these platforms facilitate the connection. The beauty of freelancing lies in its flexibility; you can set your own hours and work from anywhere with an internet connection. Building a strong online profile, showcasing your skills, and diligently pursuing available opportunities can lead to a consistent stream of income. Further, platforms like Upwork and Fiverr allow you to set your rates competitively and gain exposure to a global client base. The key is to identify your marketable skills and then actively promote them through a compelling portfolio and persuasive proposals. Remember that client satisfaction is paramount for securing repeat business and positive reviews, which are essential for attracting future clients.

Another viable option is to monetize existing assets. This could involve renting out a spare room through platforms like Airbnb or renting out your car when not in use through services like Turo. This approach allows you to generate income from resources you already possess, requiring minimal effort once the initial setup is complete. Carefully consider the logistics, legal requirements, and insurance implications of renting out your assets, ensuring you comply with all applicable regulations and adequately protect yourself against potential liabilities. For example, thoroughly screen potential renters, establish clear rules and expectations, and maintain adequate insurance coverage.

Exploring online courses and workshops can be a fruitful avenue for both skill enhancement and income generation. Platforms such as Coursera, Udemy, and Skillshare offer a vast array of courses on various topics, allowing you to learn new skills that can be monetized later or refine existing ones to increase your earning potential. Moreover, creating your own online courses based on your expertise can be a highly lucrative venture. Sharing your knowledge and experience with others not only positions you as an authority in your field but also provides a passive income stream once the course is created and launched.

Turning to the realm of cryptocurrency investments, while inherently riskier, can offer potentially significant returns. However, it's crucial to approach this market with caution, thorough research, and a sound understanding of the underlying technologies and market dynamics. Before investing any capital, dedicate time to learning about blockchain technology, different cryptocurrencies, and the factors that influence their price fluctuations. Bitcoin and Ethereum are typically considered the "blue-chip" cryptocurrencies, offering relative stability compared to smaller altcoins. Diversifying your portfolio across different cryptocurrencies can help mitigate risk. Instead of putting all your eggs in one basket, allocate your investments across several coins with varying market caps and use cases.

Consider engaging in strategies such as staking and yield farming. Staking involves holding cryptocurrency in a wallet to support the operations of a blockchain network, and in return, you earn rewards in the form of additional cryptocurrency. Yield farming, on the other hand, involves providing liquidity to decentralized finance (DeFi) platforms, earning rewards in the form of transaction fees and governance tokens. These strategies can generate passive income from your cryptocurrency holdings. Understand the impermanent loss risks associated with yield farming and choose reputable DeFi platforms.

Dollar-Cost Averaging (DCA) is a strategy to consider, especially if you are new to the cryptocurrency market. DCA involves investing a fixed amount of money at regular intervals, regardless of the asset's price. This strategy helps to average out your purchase price over time, reducing the impact of short-term price volatility. Avoid the temptation to "time the market," as this is notoriously difficult, even for experienced traders.

Be wary of scams and fraudulent schemes in the cryptocurrency space. Promises of guaranteed high returns are often red flags. Before investing in any cryptocurrency or project, thoroughly research the team behind it, the technology, and the market potential. Use reputable cryptocurrency exchanges and wallets, and always enable two-factor authentication for added security. Never share your private keys or seed phrases with anyone.

Cryptocurrency investment requires diligent risk management. Only invest what you can afford to lose, and set realistic expectations. The cryptocurrency market is highly volatile, and prices can fluctuate dramatically in short periods. Use stop-loss orders to limit potential losses. Regularly review your portfolio and adjust your investment strategy as needed.

In conclusion, navigating the period between jobs requires a multifaceted approach to income generation. Combining traditional methods like freelancing and asset monetization with potentially lucrative opportunities in the cryptocurrency market can provide financial stability and even the chance to grow your wealth. However, remember that cryptocurrency investment is inherently risky and requires careful planning, thorough research, and diligent risk management. Prioritizing financial literacy, diversifying your income streams, and remaining vigilant against scams are crucial for navigating this transition successfully and emerging stronger on the other side. Continuously adapting to new market trends and embracing lifelong learning will ensure your continued success in generating income and building a secure financial future.