The allure of making money without a traditional job is undeniably strong in today's world. It represents freedom, flexibility, and the potential to pursue passions while maintaining financial security. While the idea might sound like a pipe dream to some, it's absolutely possible, though it requires careful planning, dedication, and a realistic understanding of the risks and rewards involved. It's not a get-rich-quick scheme, but a strategic approach to building income streams independent of an employer.

The first step is a honest assessment of your skills and resources. What are you good at? What do you enjoy doing? What assets do you already possess, be it physical items, intellectual property, or a strong network? These answers will form the foundation of your income-generating strategies. For example, if you're a skilled writer, freelance work, content creation, or even writing and selling an e-book could be viable options. If you have a knack for crafts, platforms like Etsy offer a global marketplace. If you own a spare room or apartment, consider renting it out through Airbnb. The key is to identify how your existing capabilities can be monetized.

One of the most popular avenues for generating income without a job is through online ventures. The internet offers a vast array of opportunities, from starting a blog or YouTube channel to offering online courses or consulting services. The barrier to entry is relatively low, but success hinges on creating valuable content, building an audience, and consistently delivering quality. Building a successful blog, for instance, requires a significant time investment in creating engaging content, promoting it through social media, and implementing strategies for monetization, such as advertising, affiliate marketing, or selling digital products. Similarly, creating and marketing online courses demands expertise in the subject matter, excellent presentation skills, and a robust marketing plan.

Investing is another crucial component of generating passive income. However, it's essential to approach investing with a well-defined strategy and a thorough understanding of the risks involved. Diversification is paramount. Don't put all your eggs in one basket. Spread your investments across different asset classes, such as stocks, bonds, real estate, and commodities, to mitigate risk. Investing in dividend-paying stocks can provide a steady stream of income, while real estate investments, particularly rental properties, can generate consistent cash flow. However, real estate investments require significant upfront capital, ongoing maintenance, and the management of tenants.

The stock market offers numerous avenues for generating income. Besides dividend-paying stocks, consider investing in exchange-traded funds (ETFs) that track specific market indices or sectors. These ETFs offer instant diversification and can provide exposure to a wide range of companies. However, the stock market is inherently volatile, and there's always the risk of losing money. Therefore, it's crucial to conduct thorough research, understand your risk tolerance, and consider consulting with a financial advisor before making any investment decisions.

Another increasingly popular option is exploring the world of cryptocurrency. While cryptocurrencies can offer potentially high returns, they are also incredibly volatile and speculative. It's essential to approach cryptocurrency investments with extreme caution, only investing what you can afford to lose. Research different cryptocurrencies, understand the underlying technology, and be aware of the regulatory landscape. Staking cryptocurrencies, which involves holding them in a wallet to support the blockchain network, can generate passive income in the form of staking rewards. However, the value of the cryptocurrency can fluctuate significantly, impacting the overall returns.

Beyond online ventures and investments, consider exploring other alternative income streams. Peer-to-peer lending platforms allow you to lend money to individuals or businesses and earn interest on the loans. However, there's a risk of default, so it's crucial to assess the creditworthiness of borrowers carefully. Another option is selling your skills on freelance platforms like Upwork or Fiverr. You can offer services such as writing, editing, graphic design, web development, and virtual assistance. Building a strong profile and consistently delivering high-quality work are essential for success on these platforms.

The key to making money without a job is not to rely on a single source of income. Building multiple income streams is crucial for financial stability and independence. This might involve combining freelance work with investment income and a side hustle. The more diversified your income sources, the less vulnerable you are to economic downturns or unexpected expenses.

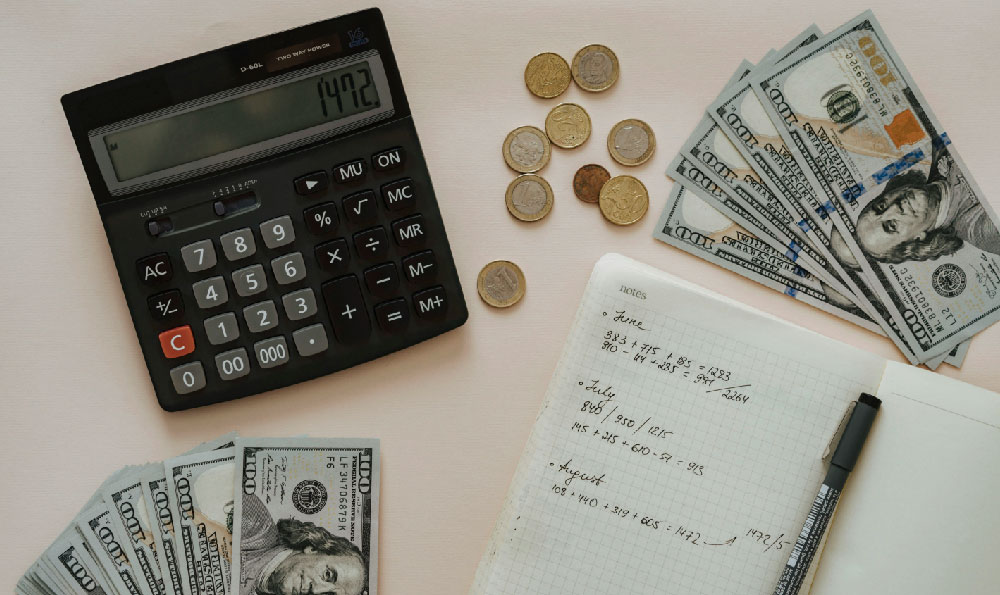

Finally, it's crucial to manage your finances responsibly. Track your income and expenses, create a budget, and avoid unnecessary debt. Building an emergency fund is essential for covering unexpected expenses and providing a financial cushion. Automating your savings and investments can help you stay on track with your financial goals. Continuously learn and adapt to the changing economic landscape. The world of finance is constantly evolving, and staying informed about new investment opportunities and income-generating strategies is essential for long-term success. Building wealth without a job is a marathon, not a sprint. It requires patience, discipline, and a willingness to learn and adapt. But with careful planning, consistent effort, and a strategic approach, it's a goal that is within reach for many.