The accumulation of extraordinary wealth on a global scale is a complex phenomenon shaped by a confluence of factors including entrepreneurial acumen, strategic investment, technological disruption, and favorable economic conditions. Identifying a single demographic that unequivocally "amasses the most wealth" is nuanced, but generally, the ultra-high-net-worth individuals (UHNWIs), entrepreneurs, and individuals with strategic investments in high-growth sectors constitute the dominant players. Understanding their methods requires a multifaceted examination of their approaches to wealth creation, preservation, and expansion.

Entrepreneurs form a significant portion of the world's wealthiest individuals. They often identify unmet needs in the market, develop innovative solutions, and build successful businesses from the ground up. This process necessitates not only a groundbreaking idea but also the ability to assemble a talented team, secure funding, navigate regulatory hurdles, and effectively manage operations. Tech entrepreneurs, in particular, have seen explosive growth in recent decades. The rapid advancement of technology and the scalability of digital platforms allow companies to reach global markets with minimal physical infrastructure, creating vast fortunes in relatively short periods. Consider the founders of major tech companies; their wealth is a direct result of creating products and services that have revolutionized industries and become integral parts of daily life for billions of people. Furthermore, the ability to anticipate future technological trends and adapt quickly to market changes is a crucial attribute of successful tech entrepreneurs.

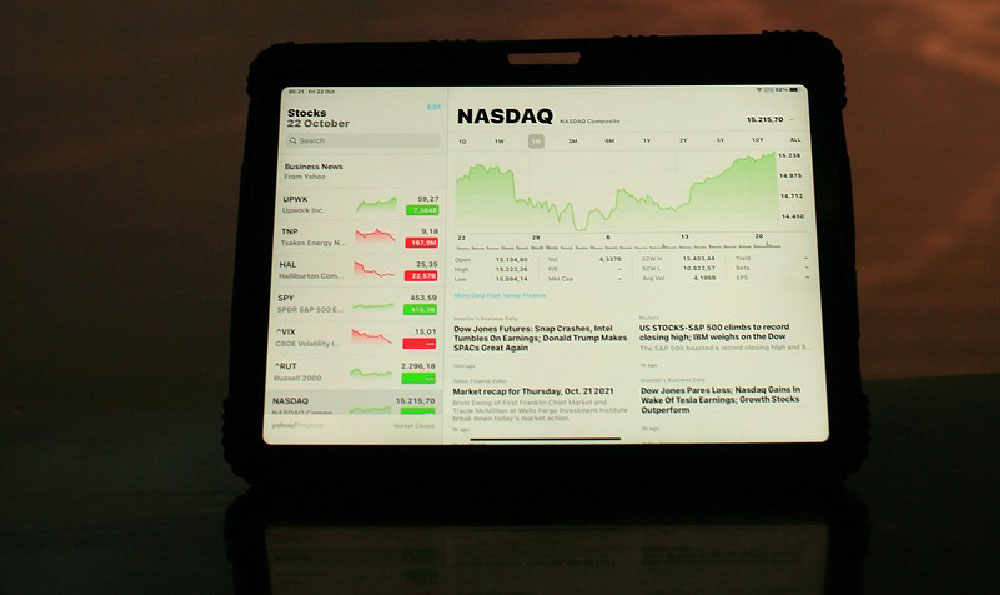

Strategic investing is another cornerstone of wealth accumulation. While entrepreneurship involves building a business, strategic investing involves allocating capital to existing businesses and assets with the goal of generating returns. UHNWIs often diversify their investments across a wide range of asset classes, including stocks, bonds, real estate, private equity, and alternative investments. This diversification mitigates risk and allows them to capitalize on different market cycles. They do not simply passively invest; they actively manage their portfolios, seeking out undervalued assets, identifying growth opportunities, and making informed decisions based on thorough research and analysis. Access to exclusive investment opportunities, such as pre-IPO investments in promising startups or direct investments in real estate developments, also plays a crucial role. These opportunities are often not available to the general public and offer the potential for significant returns. Additionally, the utilization of sophisticated financial instruments and strategies, such as hedging and tax optimization, further enhances their ability to preserve and grow wealth.

Beyond entrepreneurship and strategic investing, several other factors contribute to the accumulation of wealth. Inheritance plays a significant role, particularly for those who come from families with established fortunes. While inheriting wealth does not guarantee continued success, it provides a significant head start and access to resources and networks that are not readily available to others. However, successful wealth inheritors are typically those who understand the importance of responsible financial management and continue to grow the wealth they have inherited. They often invest in education, develop strong business acumen, and surround themselves with experienced advisors. Furthermore, favorable economic conditions and government policies can significantly impact wealth creation. Low interest rates, tax incentives, and deregulation can create a more favorable environment for businesses and investments to thrive. Conversely, economic downturns, high taxes, and restrictive regulations can hinder wealth accumulation.

The role of education and expertise cannot be overstated. Individuals who have a deep understanding of finance, economics, and business are better equipped to make informed investment decisions and manage their wealth effectively. Advanced degrees in relevant fields, coupled with practical experience, provide a significant advantage in navigating the complexities of the financial world. Moreover, continuous learning and staying abreast of market trends are essential for maintaining a competitive edge. The wealthiest individuals often invest heavily in their own education and seek out advice from leading experts in various fields. They understand that knowledge is power, and that informed decision-making is critical for long-term success.

Finally, a crucial element is the mindset and discipline required to accumulate and maintain substantial wealth. This involves a long-term perspective, a willingness to take calculated risks, and a commitment to hard work and perseverance. Wealthy individuals typically have a clear vision of their financial goals and a well-defined plan for achieving them. They are also disciplined in their spending habits and avoid unnecessary expenses. They understand the importance of saving and investing for the future, and they are willing to defer gratification in order to achieve their long-term objectives. Furthermore, they are resilient in the face of setbacks and are able to learn from their mistakes. The ability to overcome challenges and adapt to changing circumstances is essential for long-term success in any field, including wealth accumulation.

In conclusion, the accumulation of the most wealth globally is primarily achieved through a combination of entrepreneurial endeavors, strategic investments, and favorable economic circumstances. While some inherit wealth, the ability to grow and sustain it requires a deep understanding of finance, a disciplined mindset, and a willingness to take calculated risks. The wealthiest individuals are typically those who are able to identify opportunities, innovate, adapt to change, and manage their finances effectively over the long term. Their success is not solely attributable to luck or privilege, but rather to a combination of talent, hard work, and strategic decision-making.