Virtual currency investment presents a unique opportunity for students who are seeking to generate passive income while leveraging their time and learning resources. Unlike traditional financial markets, the digital asset space operates with high liquidity, round-the-clock trading, and the potential for exponential growth. For this demographic, it's essential to adopt a strategic mindset that aligns with their educational goals and financial realities. Here’s a comprehensive approach tailored to students aiming to profit from crypto while maintaining academic focus and minimizing risks.

Understanding the market dynamics is the first step in navigating this niche. Students often possess a natural curiosity and analytical skills, which can be advantageous in assessing trends, technologies, and economic factors influencing cryptocurrency prices. However, the market is inherently volatile, driven by factors such as regulatory changes, technological breakthroughs, and macroeconomic shifts. Recognizing this volatility allows students to anticipate fluctuations and adjust their strategies accordingly. For instance, a student studying economics may analyze macroeconomic indicators and their impact on blockchain adoption, while someone with a programming background can evaluate the technical robustness of a project. By integrating their academic knowledge with market insights, students can make more informed decisions that go beyond mere speculation.

A suitable investment approach for students involves balancing time commitment with educational priorities. Many students are limited by financial resources, making it crucial to start with small amounts and gradually scale as expertise grows. One effective method is dollar-cost averaging, where students invest a fixed amount regularly regardless of price fluctuations. This strategy mitigates the risk of entering the market at a peak and is ideal for those with limited initial capital. Additionally, students can explore high-yield staking opportunities, which require minimal active management while earning interest on cryptocurrencies they hold. Platforms like staking pools or decentralized finance (DeFi) protocols offer such avenues, allowing students to participate in consensus mechanisms or liquidity provision. These activities not only generate income but also deepen their understanding of blockchain technology and its applications.

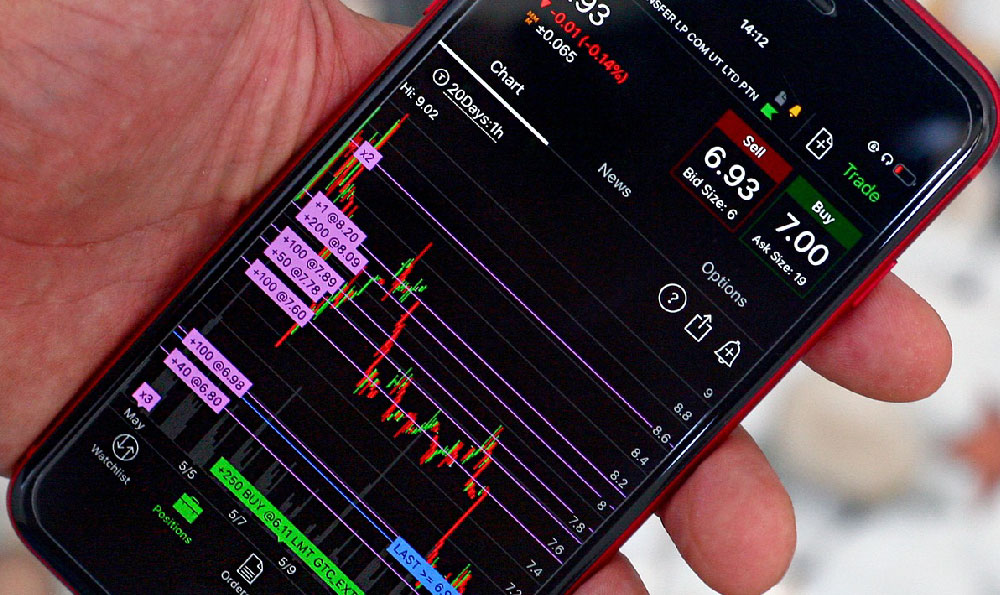

Risk management is paramount for students who are new to financial markets. Diversification remains a cornerstone strategy, as concentrating investments in a single asset or project increases exposure to volatility. Students should allocate their funds across multiple cryptocurrencies, sectors, and blockchain protocols to spread risk. For example, pairing a portion of their capital in established cryptocurrencies like Bitcoin or Ethereum with smaller, promising projects in emerging sectors such as DeFi or NFTs can create a balanced portfolio. Moreover, students can utilize stop-loss orders to automatically sell assets if they drop below a specified threshold, protecting against significant losses during market downturns. Familiarizing themselves with tools like blockchain explorers or analytical platforms (e.g., CoinMarketCap, CoinGecko) helps in monitoring risks and identifying potential upsides in real time.

Education and self-improvement are critical components of long-term success in cryptocurrency investment. Students have access to vast online resources, including tutorials, webinars, and forums, which can enhance their knowledge without requiring extensive time. Platforms like Coursera, edX, or YouTube offer free courses on blockchain fundamentals, smart contracts, and market analysis. Engaging with communities on Discord or Reddit also provides opportunities to learn from experienced investors and stay updated on industry developments. Furthermore, students can develop practical skills by participating in low-stakes trading simulations or using demo accounts provided by crypto exchanges. These exercises simulate market conditions and allow students to test strategies in a risk-free environment, fostering confidence and competence.

The key to sustainable financial growth for students lies in aligning investments with their long-term goals. While short-term gains may be tempting, focusing on value retention and compounding is more effective. For instance, a student with a strong interest in a particular cryptocurrency can allocate funds to purchase undervalued tokens with strong fundamentals, holding them until they appreciate in value. Additionally, students can explore yield farming or liquidity provision in DeFi platforms, which offer competitive returns through smart contract-based protocols. These activities require minimal time but demand a basic understanding of blockchain mechanics, making them suitable for students with varying levels of expertise.

Ultimately, cryptocurrency investment is not a get-rich-quick scheme but a long-term endeavor that demands patience, discipline, and continuous learning. Students who approach this field with a strategic mindset, prioritizing education and risk management, are better positioned to achieve financial growth while maintaining a balance with their studies. By staying informed, practicing restraint, and leveraging their unique skill sets, students can transform their financial aspirations into reality without compromising their academic journey. The digital asset space offers opportunities for innovation and profit, and for students who are willing to invest time in understanding it, the rewards can be substantial.