The allure of instant riches is a siren song that has captivated humanity for centuries, and in the age of cryptocurrencies, it seems louder than ever. Promises of overnight fortunes permeate online forums and social media feeds, often fueled by narratives of ordinary individuals who struck gold in the digital realm. While the stories of rapid gains are undeniably enticing, the reality of generating wealth in the cryptocurrency market, or indeed any investment arena, is far more nuanced and demands a cautious and informed approach.

The core appeal of cryptocurrencies lies in their potential for exponential growth. Unlike traditional asset classes, the nascent nature of the digital asset market, coupled with its inherent volatility, can create opportunities for significant profits within relatively short timeframes. Memecoins, for instance, often experience meteoric rises propelled by viral hype and community sentiment. Similarly, emerging decentralized finance (DeFi) projects can deliver substantial returns to early adopters who participate in staking or liquidity mining programs. These instances, however, should be viewed as exceptional outliers rather than the norm.

To address the question of "instant" wealth directly, it's crucial to acknowledge that genuine opportunities for immediate riches are exceedingly rare and often carry disproportionately high levels of risk. Any strategy that promises guaranteed returns within a short period should be approached with extreme skepticism. These often involve scams, Ponzi schemes, or projects with fundamentally unsustainable models. Entrusting your capital to such ventures is akin to gambling, with a far greater probability of significant loss than genuine profit.

Instead of chasing fleeting opportunities for rapid gains, a more prudent and sustainable path to wealth creation in the cryptocurrency market involves a strategic and long-term approach. This starts with a foundational understanding of the underlying technology, market dynamics, and risk factors associated with different digital assets. Bitcoin, as the pioneer cryptocurrency, serves as a crucial starting point. Understanding its decentralized nature, its limited supply, and its role as a store of value is essential for grasping the broader landscape. From there, exploring Ethereum's smart contract capabilities, the rise of DeFi, and the potential applications of various altcoins can provide a more comprehensive perspective.

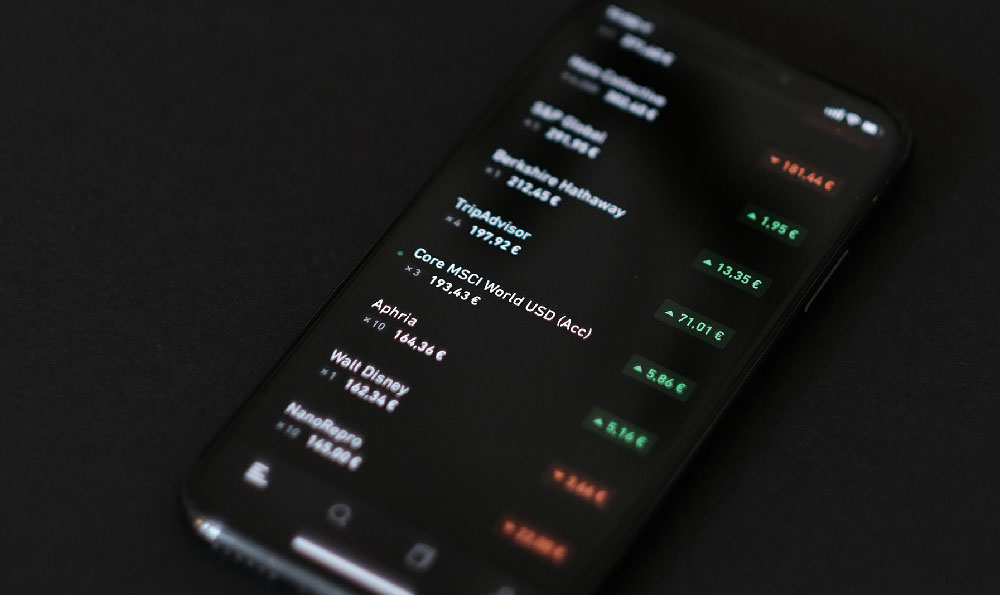

Once you have a solid understanding of the market, the next step is to develop a well-defined investment strategy. This involves setting realistic financial goals, assessing your risk tolerance, and diversifying your portfolio across different asset classes. Allocating a portion of your capital to established cryptocurrencies like Bitcoin and Ethereum can provide a stable foundation, while reserving a smaller percentage for higher-risk, higher-reward altcoins can potentially generate significant gains. However, it's crucial to conduct thorough research on each project before investing, evaluating its whitepaper, team, technology, and community support.

Effective risk management is paramount in the volatile world of cryptocurrencies. Never invest more than you can afford to lose, and always use stop-loss orders to limit potential losses. Consider using dollar-cost averaging (DCA), a strategy that involves investing a fixed amount of money at regular intervals, regardless of the price. This can help mitigate the impact of market fluctuations and reduce the risk of buying at the top.

Beyond individual asset selection, staying informed about market trends, regulatory developments, and technological advancements is crucial. Subscribe to reputable cryptocurrency news sources, follow industry experts on social media, and participate in relevant online communities. This continuous learning process will help you adapt your investment strategy to the evolving market landscape and identify emerging opportunities.

Furthermore, be wary of emotional decision-making. Fear and greed are powerful motivators that can cloud judgment and lead to impulsive actions. Avoid succumbing to FOMO (fear of missing out) when prices are rising rapidly, and resist the urge to panic sell during market downturns. A disciplined and rational approach is essential for navigating the inherent volatility of the cryptocurrency market.

While the potential for significant gains exists within the cryptocurrency market, generating wealth is not a quick or easy process. It requires dedication, research, and a long-term perspective. Focus on building a solid foundation of knowledge, developing a well-defined investment strategy, managing risk effectively, and staying informed about market trends. By adopting a prudent and disciplined approach, you can increase your chances of achieving your financial goals in the digital asset space, but always remember that responsible investing prioritizes capital preservation over the illusion of instant riches. The most reliable path to long-term wealth is consistent, informed decision-making coupled with the patience to allow your investments to grow over time. The crypto market, while offering exciting possibilities, should be approached with the same level of diligence and caution as any other serious investment endeavor.