Using debt to make money, often referred to as leveraging, is a sophisticated financial strategy that can potentially amplify returns but also carries significant risks. Whether it's truly "possible" and, more importantly, how to do it successfully requires a deep understanding of the underlying principles, careful risk management, and a clear understanding of your own financial capacity.

At its core, leveraging involves using borrowed funds to invest in assets with the expectation that the return on those assets will exceed the cost of borrowing. The difference between the return and the cost of borrowing is the profit. The allure is the potential to generate returns on a larger capital base than you personally possess. However, this magnifying effect works both ways; losses are amplified just as significantly.

Several avenues exist for employing debt to potentially generate income. One common approach is real estate investing. Imagine acquiring a rental property with a mortgage. The rental income generated ideally covers the mortgage payments, property taxes, insurance, and maintenance expenses. If the rental income significantly exceeds these costs, the difference represents positive cash flow. This cash flow can be used to pay down the mortgage faster, increasing your equity, or it can be reinvested into other properties. The key here is diligent property management, thorough tenant screening, and realistic expense forecasting. Interest rate fluctuations and vacancies are major risks that need to be carefully considered. A sudden increase in interest rates could significantly erode profitability, while prolonged vacancies can strain your finances and make it difficult to meet mortgage obligations.

Another area where debt is frequently used for wealth creation is in business ownership. Entrepreneurs often take out loans to start or expand their businesses. The rationale is that the business's revenue and profits will far surpass the cost of the loan. This is a higher-risk endeavor because business success isn't guaranteed and is subject to market forces, competition, and the owner's management skills. A comprehensive business plan, meticulous financial projections, and a contingency fund are essential. Successful entrepreneurs who leverage debt for business growth demonstrate a strong understanding of their industry, a clear competitive advantage, and the ability to adapt to changing market conditions. The repayment schedule of the debt needs to be carefully aligned with the business's projected cash flow to avoid default.

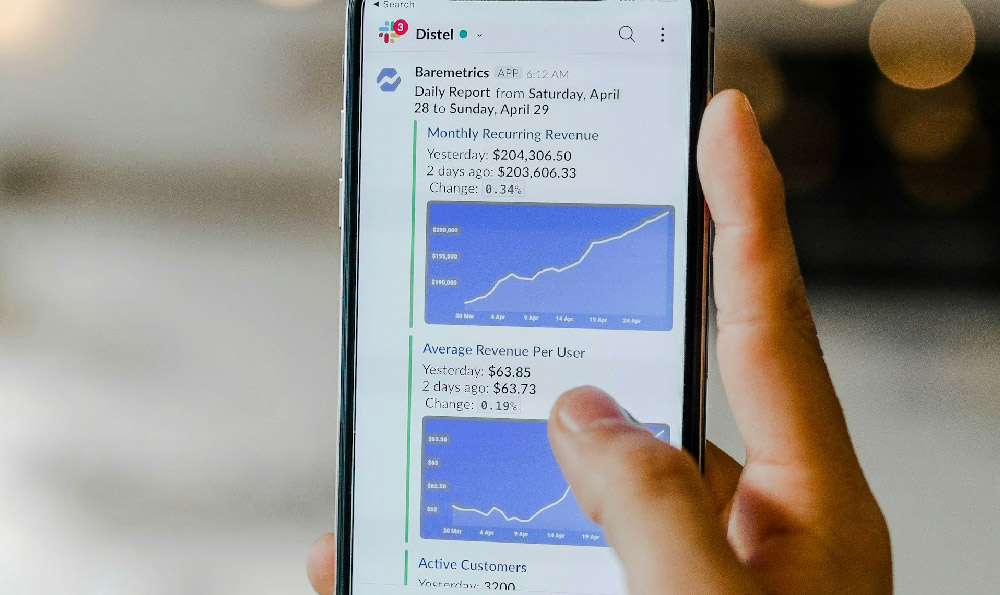

Investing in securities, specifically stocks, using margin loans is another form of leveraging. Margin loans allow investors to borrow money from their brokerage firm to purchase securities. The potential for gains is increased, but so is the risk of losses. If the investment performs poorly, the investor is still obligated to repay the loan, and in extreme cases, the brokerage firm may issue a margin call, requiring the investor to deposit additional funds to cover the losses. Failure to meet the margin call can result in the forced liquidation of the investor's holdings, potentially locking in significant losses. Margin loans are best suited for sophisticated investors with a high-risk tolerance, a deep understanding of market dynamics, and the ability to actively monitor their positions. A conservative approach is vital; avoid overleveraging and focus on fundamentally sound companies with a track record of stability and growth.

While leveraging can be tempting, there are several crucial factors to consider before taking on debt for investment purposes.

First, assess your risk tolerance and financial capacity. How much risk are you comfortable taking? Can you withstand potential losses without jeopardizing your financial stability? A thorough understanding of your own risk profile is essential. Don't risk more than you can afford to lose.

Second, calculate the true cost of borrowing. Don't just focus on the interest rate; consider all associated fees, closing costs, and potential prepayment penalties. Understand the terms of the loan and ensure you can comfortably meet the repayment obligations, even in adverse circumstances.

Third, conduct thorough due diligence. Whether you're investing in real estate, a business, or securities, research is paramount. Understand the potential risks and rewards associated with each investment. Don't rely on gut feelings or hearsay; base your decisions on solid data and analysis.

Fourth, develop a robust risk management strategy. Implement stop-loss orders to limit potential losses on margin loans. Diversify your investments to reduce overall risk. Maintain an emergency fund to cover unexpected expenses.

Fifth, monitor your investments closely. Regularly review your portfolio and track the performance of your leveraged investments. Be prepared to adjust your strategy if necessary. Market conditions can change rapidly, and it's important to stay informed and proactive.

Sixth, seek professional advice. Consider consulting with a financial advisor who can help you assess your risk tolerance, develop a suitable investment strategy, and manage your leveraged investments. A qualified advisor can provide objective guidance and help you avoid costly mistakes.

It's important to acknowledge that leveraging is not a guaranteed path to wealth. It's a tool that, when used responsibly and strategically, can potentially amplify returns. However, it's equally capable of amplifying losses and leading to financial ruin if not managed carefully. Before venturing into leveraged investing, seriously consider your aptitude, financial situation, and risk appetite. A measured, informed approach is essential for success. In many cases, building wealth through consistent savings and prudent, unleveraged investing is a safer and more sustainable path to long-term financial security. The key is to choose the strategy that best aligns with your individual circumstances and goals.