The question of whether a 5% return on investment (ROI) is "good" is deceptively simple. The honest answer is: it depends. It depends on a multitude of factors, including your individual financial goals, risk tolerance, investment timeframe, the prevailing economic climate, and the specific types of investments you're considering. To truly assess the merits of a 5% ROI, we need to dissect these considerations and place them within a broader context.

Let's start with the concept of "good" itself. For someone nearing retirement with a low-risk appetite and a primary goal of preserving capital, a steady 5% return might be considered excellent. It provides a reliable income stream while minimizing the potential for losses. On the other hand, a young investor with a long investment horizon and a higher risk tolerance might view 5% as inadequate. They might seek higher returns through more aggressive investments, accepting the associated volatility in pursuit of greater long-term wealth accumulation.

Inflation is a critical factor to consider. A 5% ROI is only meaningful when compared to the prevailing inflation rate. If inflation is running at 3%, your real return is only 2%. This real return represents the actual increase in your purchasing power. Therefore, a 5% ROI in a high-inflation environment might be insufficient to maintain your current standard of living, let alone grow your wealth significantly. In contrast, a 5% ROI when inflation is low might be quite attractive.

The risk-free rate of return, typically represented by government bonds, serves as a benchmark. Investors generally expect to earn a premium above the risk-free rate to compensate them for taking on additional risk. If government bonds are yielding 3%, then a 5% ROI on a riskier investment might be acceptable, as it provides a 2% risk premium. However, if government bonds are yielding 4.5%, a 5% ROI might not be worth the added risk.

Different asset classes offer varying levels of risk and return. Savings accounts and certificates of deposit (CDs) typically offer lower returns but are virtually risk-free. Bonds offer a slightly higher return with relatively low risk, depending on the issuer's creditworthiness. Stocks, on the other hand, offer the potential for significantly higher returns but come with greater volatility. Real estate can also provide attractive returns, but it involves illiquidity and management responsibilities. Diversifying your portfolio across different asset classes can help to mitigate risk and potentially enhance returns. A portfolio heavily weighted towards low-risk assets might yield a lower overall ROI, while a portfolio heavily weighted towards high-risk assets might yield a higher ROI, but with greater fluctuations.

Consider the specific investments generating the 5% ROI. Is it coming from a dividend-paying stock portfolio, a bond fund, a rental property, or a peer-to-peer lending platform? Each of these investments carries its own unique set of risks and rewards. A 5% dividend yield from a stable, blue-chip company might be very desirable, while a 5% return from a speculative investment might be cause for concern. Understand the underlying assets, the management fees involved, and the potential for capital appreciation or depreciation.

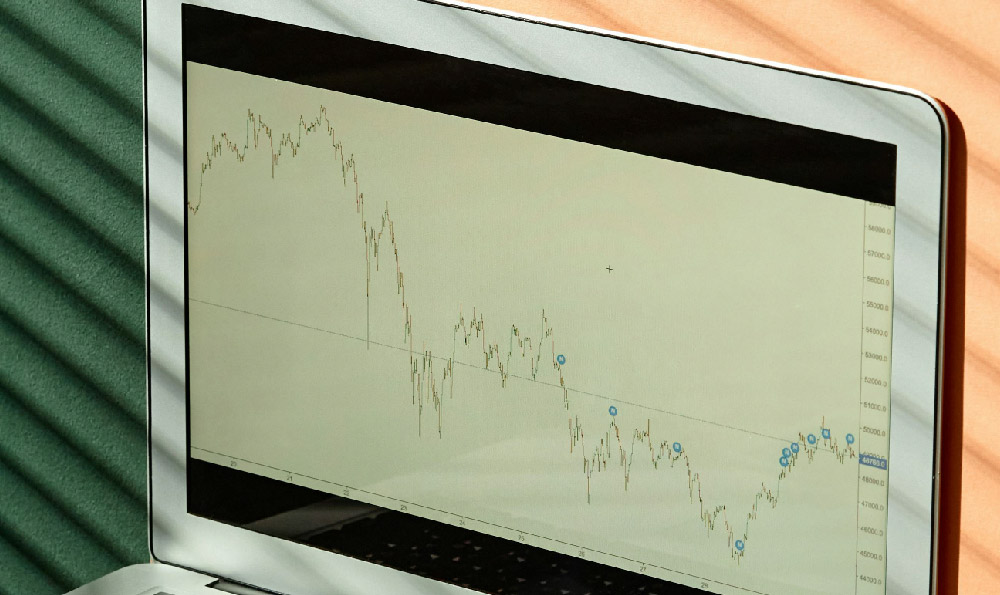

Your investment timeframe also plays a crucial role. Over a short period, market volatility can significantly impact returns. A 5% ROI over a single year might be considered disappointing, especially in a bull market. However, over a longer period, even a modest 5% ROI can compound significantly, leading to substantial wealth accumulation. This highlights the importance of long-term investing and the power of compounding. Patience and discipline are essential virtues for successful investing.

Should you aim higher than 5%? The answer depends on your circumstances. If you have a long investment horizon, a high-risk tolerance, and a desire for significant wealth accumulation, you might consider allocating a portion of your portfolio to higher-growth investments. However, it's crucial to do your research, understand the risks involved, and be prepared for potential losses. Remember that higher returns always come with higher risks. Trying to chase exceptionally high returns without properly assessing the risks can lead to disastrous consequences.

Ultimately, the ideal ROI is the one that helps you achieve your financial goals while aligning with your risk tolerance and investment timeframe. There's no one-size-fits-all answer. Instead of focusing solely on a specific percentage, focus on creating a well-diversified portfolio that is designed to meet your individual needs and circumstances. Regularly review your portfolio, rebalance it as necessary, and stay informed about market trends. Consider consulting with a qualified financial advisor who can provide personalized advice and guidance.

Instead of blindly chasing higher returns, prioritize a strategic and informed approach to investing. Understand the risks involved, diversify your portfolio, and stay disciplined in your investment strategy. A sustainable and well-managed portfolio that consistently delivers a reasonable return is far more valuable than a volatile portfolio that promises high returns but carries excessive risk. Remember that investing is a marathon, not a sprint. Consistent effort and a long-term perspective are the keys to building lasting wealth.