Investing in penny stocks can be a high-risk, high-reward endeavor that attracts both seasoned traders and newcomers eager to capitalize on market opportunities. While the allure of quick profits often drives interest in this niche, a successful approach requires more than just luck—it demands a strategic mindset, rigorous research, and a deep understanding of the markets that underpin these stocks. For beginners, navigating this terrain without falling into common pitfalls requires a blend of knowledge, patience, and disciplined execution. Let’s explore the nuances of penny stock investing, from identifying undervalued opportunities to managing risks that could otherwise derail even the most optimistic trades.

Penny stocks typically refer to shares of companies trading at very low prices, often below $5 per share. These stocks are often listed on over-the-counter (OTC) markets or through broker-dealer platforms, which can lack the transparency and liquidity of major stock exchanges. The appeal of penny stocks lies in their potential for significant price appreciation, especially if the underlying company experiences a surge in demand or announces a major development. However, this potential comes with unique challenges, as the same volatility that can lead to gains can also cause catastrophic losses if not managed properly. A trader’s success hinges on their ability to separate genuine opportunities from speculative bubbles.

For those new to this arena, the first step involves understanding the fundamentals of company valuation. Unlike larger, more established firms, penny stocks often have sparse financial data, making it difficult to assess their true worth. Traders should focus on metrics such as revenue growth, earnings reports, and industry momentum, even if these figures are not immediately obvious. For instance, a company with a positive revenue trend but limited public information may still present a compelling case if its sector is experiencing rapid expansion or if it has a strong R&D pipeline. Identifying such companies requires digging into business plans, market trends, and expert analyses, which can be time-consuming but ultimately rewarding.

Another critical factor is the psychological aspect of trading. Penny stocks are notorious for their ability to trigger emotional responses. Fear and greed often drive investors to overpay for stocks that are unlikely to appreciate, or to sell at a loss after a single negative event. Developing a disciplined mindset is essential to avoid these mistakes. Traders should approach penny stocks with the same seriousness as any other investment, setting clear objectives and adhering to predetermined strategies. For example, establishing a strict stop-loss order can help mitigate downside risk by automatically selling a stock if it drops below a specific threshold, preventing the temptation to hold onto a losing position in hopes of a rebound.

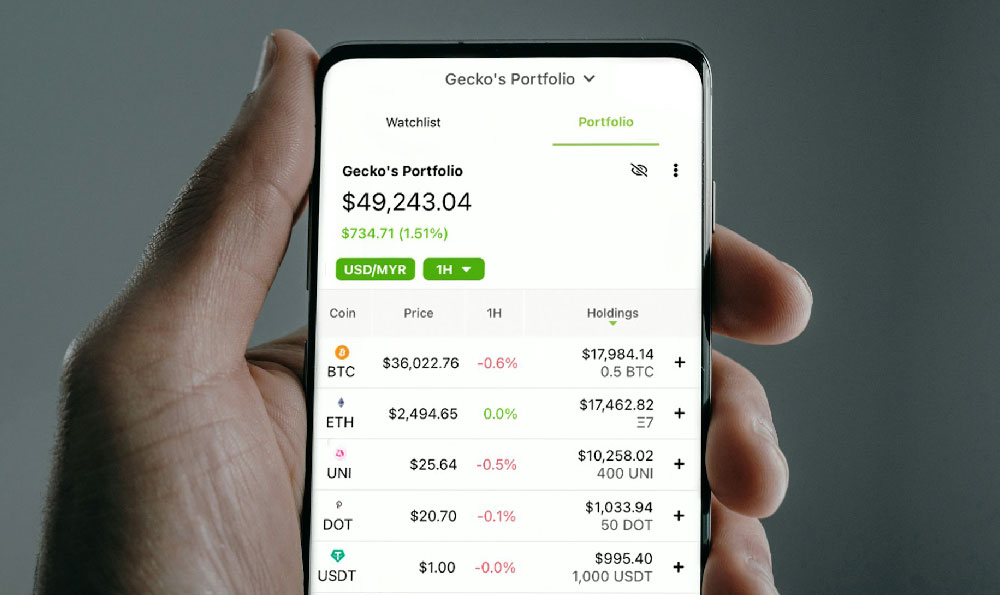

While the focus is on equities, it’s worth noting that the principles of risk management and opportunity identification extend to other asset classes, including cryptocurrencies. Both domains require a deep dive into market dynamics and a careful evaluation of the potential for growth. However, the structure of cryptocurrency markets differs in key ways—such as decentralized governance, volatility-driven pricing, and the absence of traditional financial reporting—making them a distinct risk profile. For those interested in exploring this parallel, understanding these differences is the first step toward making informed decisions.

The technical side of trading penny stocks is equally important. Traders must analyze patterns, volume spikes, and market sentiment to anticipate movements. For example, a sudden surge in trading volume paired with a breakout above key resistance levels may signal the start of a positive trend. Utilizing tools such as candlestick charts, Fibonacci retracements, and moving averages can provide valuable insights, but these techniques should be applied with caution. Overreliance on technical analysis without considering the underlying business fundamentals can lead to poor decisions, especially in a market where information is often incomplete or misleading.

Risk assessment cannot be overstated. For beginners, it’s crucial to diversify holdings across multiple stocks to avoid concentration risk. Investing all capital into a single penny stock is a recipe for disaster, as a single event—such as a regulatory crackdown or a misstep in corporate strategy—could erase years of gains. Setting aside a dedicated portion of funds for penny stock trading and treating it as a separate portfolio can help maintain financial discipline. Additionally, traders should consider the liquidity of the stock in question. Illiquid stocks may be difficult to sell at favorable prices, especially in a downturn, and could trap investors in a losing position for extended periods.

Avoiding common pitfalls is a cornerstone of successful penny stock investing. One of the most frequent mistakes is chasing hype. Many traders are drawn to stocks that have recently been promoted by analysts or social media trends, only to discover that these stocks lack sustainable value. Conducting thorough due diligence is necessary to distinguish between genuine opportunities and speculative noise. For example, a company with a strong product lineup and a loyal customer base may offer better long-term potential than one with a vague business model and a history of poor management. Another mistake is failing to understand the regulatory environment. Some penny stocks are subject to stringent oversight, while others operate in gray areas that could lead to legal complications. Researching the company’s compliance history and industry regulations can help traders avoid these risks.

Long-term profitability in penny stock trading is not guaranteed. It requires patience, as some stocks may take months or even years to mature. For instance, a small biotech firm may need several years to develop and commercialize its products before its stock becomes valuable. Traders should remain focused on their long-term goals, resisting the urge to engage in short-term speculation that could lead to impulsive decisions. Staying informed about macroeconomic trends, market cycles, and industry innovations is also vital, as these factors can influence the performance of penny stocks.

Ultimately, the journey of penny stock investing is one of continuous learning and adaptation. For beginners, starting with small positions, focusing on high-conviction trades, and regularly reviewing performance are essential steps toward greater success. The market is inherently unpredictable, but a trader who approaches it with knowledge, patience, and discipline can navigate its challenges more effectively. Whether it’s penny stocks, cryptocurrencies, or other investment vehicles, the ability to analyze, adapt, and act with clarity often determines profitability in the long run.

The path to profitability with penny stocks is complex, requiring a combination of technical skills, fundamental analysis, and emotional control. By focusing on companies with strong growth potential, maintaining strict risk management practices, and staying informed about market dynamics, beginners can increase their chances of success. However, it’s also important to acknowledge that this is not a guaranteed path—only a strategy that requires consistent effort and a willingness to learn from both victories and setbacks. As with any investment, the goal is to make informed decisions that align with long-term objectives, rather than chasing short-term gains that could jeopardize financial stability.