Investing in the stock market can be a powerful way to grow your wealth over time, but it requires knowledge, patience, and a well-thought-out strategy. There's no magic formula for guaranteed profits, but by understanding fundamental principles and employing effective techniques, you can significantly increase your chances of success.

Let's start with the basics. Understanding what stocks actually are is crucial. A stock represents a share of ownership in a company. When you buy a stock, you're essentially buying a small piece of that business. Its value fluctuates based on a multitude of factors, including the company's performance, industry trends, economic conditions, and even investor sentiment. This inherent volatility is what creates both the opportunity for profit and the risk of loss.

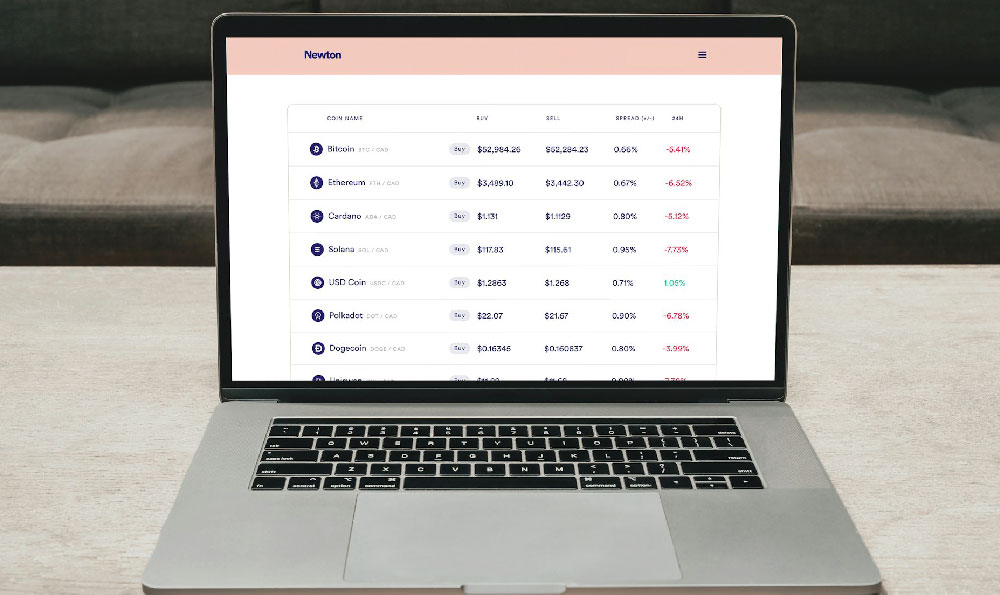

One of the first decisions you'll face is choosing a brokerage account. Numerous online platforms offer access to the stock market, each with its own fee structure, trading tools, and research resources. Consider your investment style and needs when selecting a broker. If you're a beginner, a platform with educational materials and a user-friendly interface might be preferable. If you're a more experienced trader, you might prioritize a platform with advanced charting tools and lower commissions.

Once you have an account, the real work begins: research. Investing blindly is a recipe for disaster. You need to understand the companies you're investing in, their industries, and the overall economic landscape. This involves delving into financial statements, reading analyst reports, and staying informed about current events.

There are two primary approaches to stock analysis: fundamental analysis and technical analysis. Fundamental analysis focuses on evaluating a company's intrinsic value by examining its financial health, management team, competitive advantages, and growth prospects. This involves analyzing balance sheets, income statements, and cash flow statements to assess profitability, debt levels, and efficiency. A key metric is the price-to-earnings (P/E) ratio, which compares a company's stock price to its earnings per share. A low P/E ratio might indicate that a stock is undervalued, while a high P/E ratio might suggest it's overvalued. However, P/E ratios should always be compared to those of similar companies in the same industry.

Technical analysis, on the other hand, focuses on identifying patterns in stock prices and trading volumes to predict future price movements. Technical analysts use charts and various indicators to identify support and resistance levels, trends, and potential entry and exit points. While fundamental analysis is more focused on the long-term value of a company, technical analysis is often used for short-term trading strategies.

Diversification is a cornerstone of successful stock investing. Don't put all your eggs in one basket. Spreading your investments across different stocks, industries, and even asset classes can significantly reduce your overall risk. If one stock performs poorly, the others can help cushion the blow. A common way to diversify is through index funds or exchange-traded funds (ETFs), which track a specific market index, such as the S&P 500. These funds provide instant diversification with relatively low expense ratios.

Several investment strategies can be employed, depending on your risk tolerance and investment goals. Value investing involves identifying undervalued stocks that are trading below their intrinsic worth. Growth investing focuses on companies with high growth potential, even if they may be relatively expensive. Dividend investing prioritizes stocks that pay regular dividends, providing a steady stream of income.

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the stock price. This helps to smooth out the impact of market volatility, as you'll buy more shares when prices are low and fewer shares when prices are high. Over time, this can lead to a lower average cost per share.

It's equally important to understand and manage risk. Never invest more than you can afford to lose. Before investing in any stock, consider your risk tolerance. Are you comfortable with the possibility of losing a significant portion of your investment, or do you prefer a more conservative approach? Setting stop-loss orders can help limit your potential losses by automatically selling a stock if it falls below a certain price.

Avoid emotional investing. Making decisions based on fear or greed can lead to poor choices. Stick to your investment strategy and avoid chasing short-term trends or hyped-up stocks. It’s easy to get caught up in the excitement of a rising market or panic during a downturn, but successful investors remain disciplined and rational.

Be wary of scams and get-rich-quick schemes. The stock market is often targeted by fraudsters who promise guaranteed returns or insider information. If something sounds too good to be true, it probably is. Always do your own research and be skeptical of unsolicited investment advice.

Finally, remember that investing in the stock market is a long-term game. Don't expect to get rich overnight. It takes time, patience, and discipline to build wealth through stocks. Stay informed, stay diversified, and stay focused on your long-term goals. Regularly review your portfolio and make adjustments as needed, but avoid making impulsive decisions based on short-term market fluctuations. Continuously educate yourself about the market and different investment strategies. The more you know, the better equipped you'll be to make informed decisions and achieve your financial goals. Investing is a journey, not a destination.