Here's an article addressing Non-Custodial Trade Handlers, focusing on Keepbit, as requested:

The world of cryptocurrency offers exciting opportunities, but also presents unique challenges, particularly when it comes to security and control of your assets. Among the key innovations addressing these challenges are non-custodial trade handlers, tools designed to empower users with greater control over their trading activities. Keepbit is one such example, and understanding its functionality and security implications is crucial for anyone considering its use.

Let's first understand what makes a trade handler non-custodial. In essence, it means you, and only you, retain complete control of your private keys. Unlike centralized exchanges where you deposit your funds and relinquish control to the platform, a non-custodial trade handler never has access to your private keys or the ability to move your funds without your explicit authorization. This drastically reduces the risk of your assets being compromised by exchange hacks, internal fraud, or regulatory seizure. You sign transactions directly from your wallet, ensuring your funds stay within your control throughout the trading process. This fundamental principle of self-custody is the bedrock of security within the decentralized finance (DeFi) space.

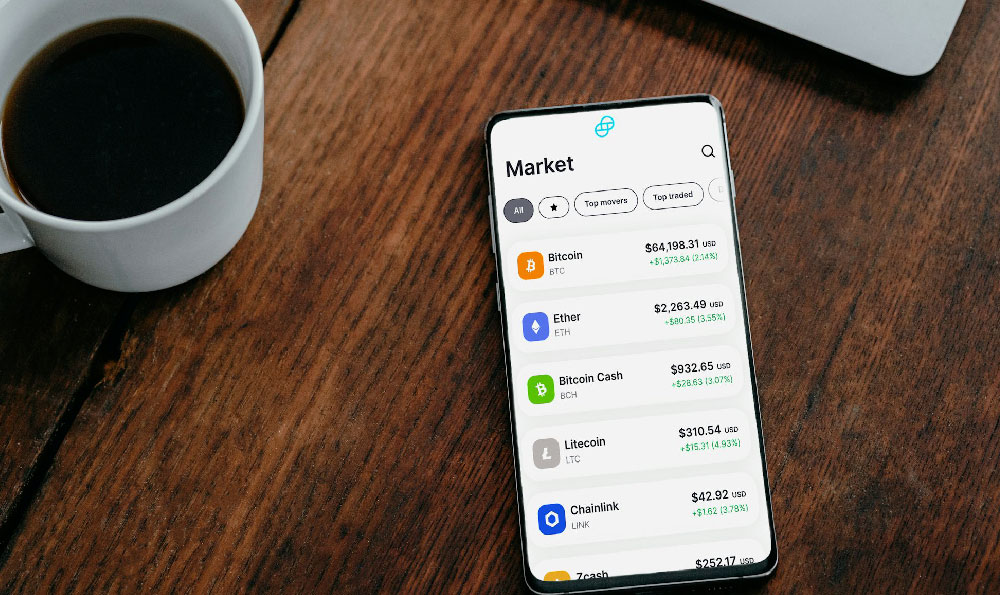

Keepbit, specifically, aims to facilitate trading on various decentralized exchanges (DEXs) while maintaining this non-custodial principle. It acts as an interface streamlining the process of connecting your wallet, selecting trading pairs, and executing trades. Its value proposition lies in its potential to simplify the user experience often associated with interacting directly with DEXs. Many DEXs can have clunky interfaces or require a deeper understanding of on-chain transactions. Keepbit, in theory, provides a more user-friendly front-end, making DeFi trading more accessible to a wider audience. It often integrates with multiple DEXs, providing access to greater liquidity and potentially better pricing than relying on a single platform.

However, the question of security surrounding Keepbit, or any non-custodial trade handler, deserves careful consideration. While the core principle of self-custody mitigates the risks associated with centralized exchanges, it does not eliminate all security concerns. The security of Keepbit hinges on several factors, primarily the integrity of its code and the security practices of its users.

The code behind Keepbit must be rigorously audited to ensure it is free from vulnerabilities. Smart contract bugs, especially those involving financial transactions, can have devastating consequences. Even a seemingly minor flaw can be exploited by malicious actors to drain funds or manipulate trades. Reputable non-custodial trade handlers will undergo independent audits by cybersecurity firms, and the results of these audits should be publicly available. Transparency is key; users should be able to review the audit reports and understand the potential risks involved. Before trusting any platform, scrutinize the documentation available about its security measures, look for mentions of audits, and research the reputation of the development team.

Beyond the platform’s code, your personal security practices are paramount. Non-custodial solutions put the onus of security squarely on your shoulders. Securing your private keys is non-negotiable. Never share your private keys or seed phrases with anyone, regardless of who they claim to be. Store your private keys securely, preferably using a hardware wallet. Hardware wallets are physical devices that store your private keys offline, making them much more resistant to hacking attempts. Be wary of phishing attacks. Malicious actors may try to trick you into revealing your private keys or signing malicious transactions by impersonating legitimate services or individuals. Always double-check the website address and transaction details before interacting with any platform. Enable two-factor authentication (2FA) on all your accounts for an added layer of security.

Furthermore, it's essential to understand the specific mechanisms Keepbit uses to interact with DEXs. Does it rely on smart contracts? If so, what security measures are in place to protect against common smart contract vulnerabilities such as reentrancy attacks or front-running? Are there any limitations on the types of tokens or DEXs it supports? Understanding these details will help you assess the potential risks and make informed decisions.

Another aspect to investigate is the potential for "rug pulls" or project abandonment. While Keepbit, by its non-custodial nature, cannot directly steal your funds in the way a centralized exchange might, the project could still be abandoned by its developers, leaving users with a platform that is no longer maintained or updated. This could expose them to new vulnerabilities or make it difficult to access their funds. Research the team behind Keepbit, their track record, and their long-term commitment to the project. A thriving community and active development are positive signs.

Finally, consider the legal and regulatory landscape surrounding cryptocurrency and DeFi. Regulations are constantly evolving, and there is a risk that certain activities or platforms could become subject to increased scrutiny or even outright prohibition. Staying informed about these developments is crucial for mitigating legal and regulatory risks.

In conclusion, Keepbit, like other non-custodial trade handlers, offers a compelling alternative to centralized exchanges, providing users with greater control over their assets. However, it is not a silver bullet for all security concerns. A thorough understanding of the platform's architecture, its security measures, and your own personal security practices is essential for mitigating risks. Before entrusting your funds to any non-custodial solution, conduct thorough research, seek expert advice, and exercise caution. The responsibility for protecting your digital assets ultimately rests with you. By combining the benefits of self-custody with a vigilant approach to security, you can navigate the exciting, yet complex, world of cryptocurrency trading with greater confidence.