Investing in Costco Wholesale Corporation (COST) is a compelling prospect for several reasons, primarily revolving around its unique business model and consistent performance. However, as with any investment, it's crucial to approach it with a well-informed strategy, considering both the potential benefits and inherent risks. Costco isn't just a retailer; it's a membership-driven business with exceptionally high renewal rates, often exceeding 90% in North America. This loyal customer base provides a stable and predictable revenue stream, which is a significant advantage in the volatile retail landscape. Costco thrives on volume, offering bulk products at competitive prices. This strategy attracts a diverse demographic, from families seeking value to small businesses looking to stock up. The company's Kirkland Signature brand further enhances profitability, offering high-quality products at even more attractive prices, boosting margins and strengthening customer loyalty.

From a financial perspective, Costco has demonstrated consistent growth in revenue and earnings. Its stock has historically outperformed the broader market, reflecting investors' confidence in its long-term prospects. The company also returns value to shareholders through dividends and share repurchases, further enhancing its appeal as an investment. Analyzing Costco's financial statements reveals a healthy balance sheet. The company manages its debt effectively and maintains a strong cash flow, allowing it to invest in growth initiatives, such as opening new warehouses and expanding its e-commerce presence. Costco's e-commerce strategy, while not its primary focus, is steadily growing, offering another avenue for revenue generation and adapting to changing consumer behavior.

Now, let’s delve into the 'how' of investing in Costco stock. There are several approaches, each with its own risk profile and potential return. One option is to invest directly in Costco shares through a brokerage account. This provides the most direct exposure to the company's performance, but also carries the full risk of market fluctuations. Before investing directly, it's essential to conduct thorough research, analyze the company's financials, and understand its business model. Consider factors like revenue growth, profit margins, debt levels, and management's strategic vision.

Another approach is to invest in Costco indirectly through exchange-traded funds (ETFs) or mutual funds that hold Costco shares. This provides diversification, reducing the risk associated with investing in a single stock. Many consumer discretionary ETFs and broad market index funds include Costco in their holdings. While this offers less direct exposure to Costco's performance, it can be a more conservative approach, particularly for investors with a lower risk tolerance. Research the specific holdings of the ETF or mutual fund to ensure it aligns with your overall investment strategy.

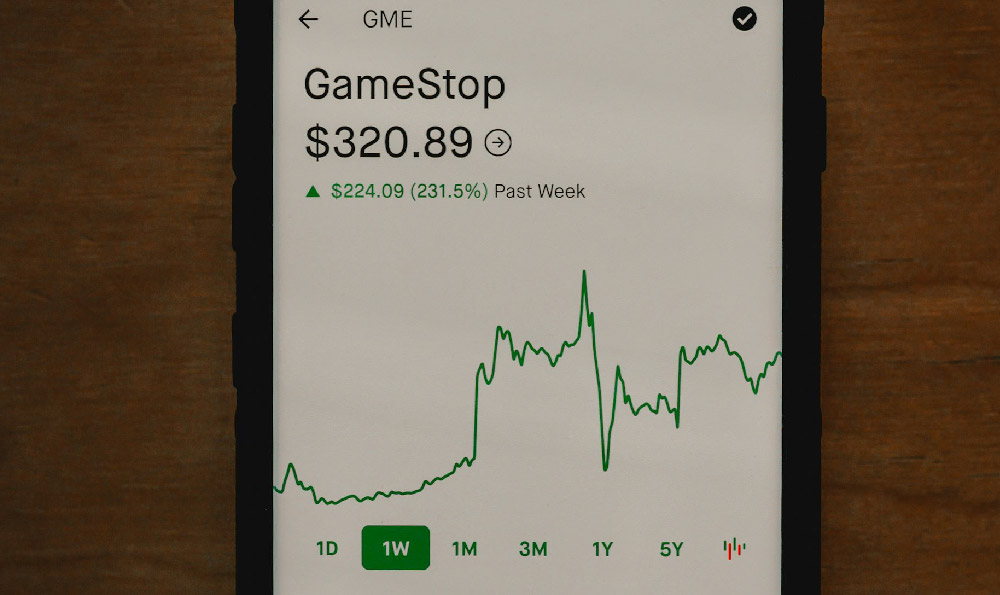

A key aspect of any investment strategy is timing. While it's impossible to perfectly time the market, there are factors to consider when deciding when to buy Costco stock. Market corrections or economic downturns may present opportunities to buy shares at a discounted price. However, it's crucial to be prepared to hold the stock for the long term, as short-term market fluctuations are inevitable. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, can help mitigate the risk of buying at a high price. This approach allows you to accumulate shares gradually over time, regardless of market fluctuations.

Before investing in Costco, consider the potential risks. While Costco's business model is resilient, it's not immune to economic downturns or changes in consumer behavior. Increased competition from online retailers and other wholesale clubs could also impact its performance. Another factor to consider is the company's reliance on membership fees. If renewal rates decline significantly, it could negatively affect its revenue and profitability. Supply chain disruptions and inflationary pressures can also impact Costco's cost structure and profitability. Carefully evaluate these risks and consider how they might affect your investment.

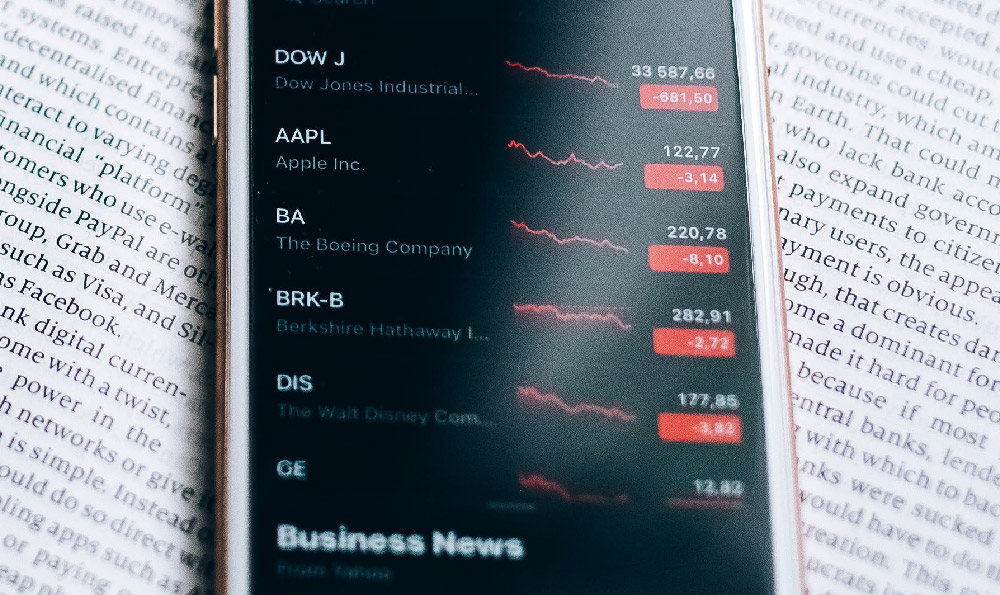

Furthermore, consider the opportunity cost. Investing in Costco means foregoing other investment opportunities. Evaluate the potential returns of alternative investments and assess whether Costco aligns with your overall financial goals and risk tolerance. Don't put all your eggs in one basket. Diversification is crucial for managing risk and maximizing returns. Allocate your investment portfolio across different asset classes, industries, and geographic regions. This will help cushion your portfolio against market volatility and reduce the impact of any single investment's performance.

Protecting your investment involves ongoing monitoring and due diligence. Regularly review Costco's financial performance, industry trends, and competitive landscape. Stay informed about company news, analyst ratings, and economic indicators. Be prepared to adjust your investment strategy if necessary, based on changing market conditions or company performance. Have a clear exit strategy in place. Determine when you would sell your Costco shares, based on factors like your investment goals, risk tolerance, and market conditions. This will help you avoid making emotional decisions and protect your profits.

Finally, remember that investing involves risk, and there are no guarantees of returns. Seek advice from a qualified financial advisor before making any investment decisions. A financial advisor can help you assess your risk tolerance, develop a personalized investment strategy, and monitor your portfolio. Approach investing in Costco stock with a long-term perspective, focusing on the company's fundamental strengths and growth potential. While short-term market fluctuations are inevitable, a well-informed and disciplined investment strategy can help you achieve your financial goals.