Bitcoin has emerged as a groundbreaking asset in the global financial ecosystem, offering individuals unique opportunities to generate income. As digital currencies continue to reshape traditional investment avenues, it's essential to grasp the fundamentals before diving into this unconventional market. Unlike conventional assets such as stocks or real estate, Bitcoin operates on a decentralized network, making it both transparent and accessible to anyone with an internet connection. This guide explores how beginners can leverage Bitcoin to achieve financial gains, emphasizing practical strategies and risk management.

The journey into cryptocurrency begins with understanding its core mechanics. Bitcoin, the first and most well-known cryptocurrency, was introduced in 2009 by an anonymous developer. It relies on blockchain technology, a distributed ledger that records all transactions across a network of computers. This system ensures security and eliminates the need for a central authority, allowing individuals to transact directly without intermediaries. For newcomers, the key is to familiarize themselves with how Bitcoin functions, its market dynamics, and the role of mining in sustaining the network. Mining, which involves solving complex mathematical problems to validate transactions, is crucial for maintaining Bitcoin's security but is not the only way to profit. Investors can also participate in trading, staking, or utilizing Bitcoin for everyday purchases to capitalize on its value.

To start earning with Bitcoin, it's important to explore various income-generating methods. One of the most straightforward is long-term holding, often referred to as "HODLing." By purchasing Bitcoin and retaining it over time, investors can benefit from its growth potential. Historical data indicates that Bitcoin's value has increased significantly over the years, making it an attractive option for those willing to adopt a patient approach. However, long-term holding requires careful selection of storage solutions. Hardware wallets, which are physical devices storing private keys offline, are considered the most secure option. Alternatively, software wallets and exchange platforms offer convenience but come with higher security risks. Beginners should prioritize secure storage methods to protect their assets from potential threats.

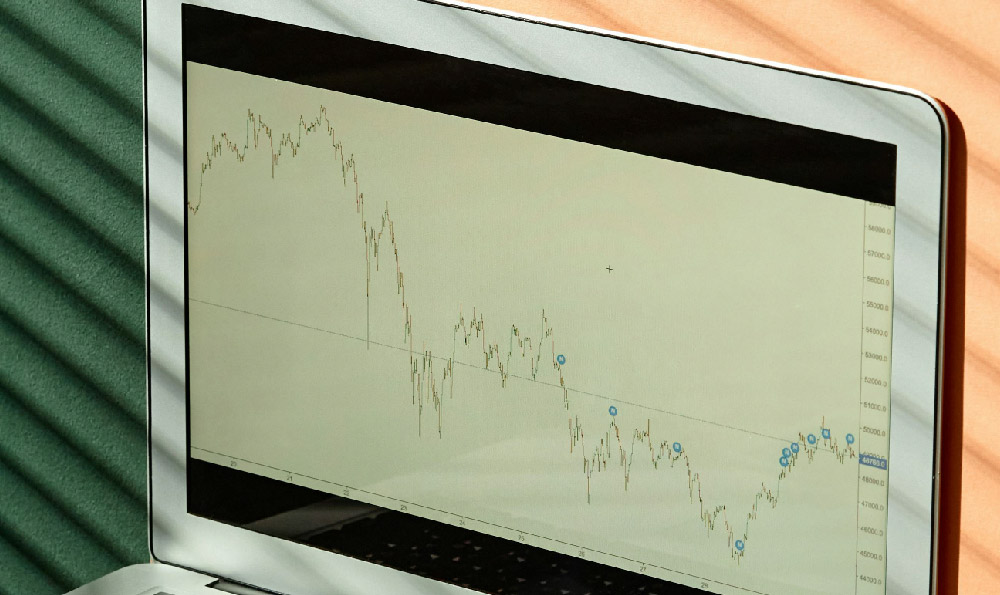

Another approach is active trading, which involves buying and selling Bitcoin based on market trends and price fluctuations. This method requires a deep understanding of market analysis, including technical indicators and fundamental factors. Traders often use tools such as candlestick charts and moving averages to predict price movements. However, trading carries inherent risks, particularly for newcomers unfamiliar with market volatility. It's advisable to start with small investments, gradually building experience while keeping a close eye on market conditions. Strategies such as day trading or swing trading can be explored, but they demand discipline and a clear understanding of risk tolerance.

For those interested in more advanced methods, staking and lending present opportunities to earn interest on Bitcoin holdings. Staking involves validating transactions on a blockchain network, earning rewards in return. This process is more accessible to holders of proof-of-stake cryptocurrencies, though Bitcoin operates on a proof-of-work mechanism. Nevertheless, platforms offering Bitcoin lending services allow users to deposit their Bitcoin and earn interest. These services often require a digital wallet and a secure account, making them suitable for individuals with a basic understanding of cryptocurrency operations. The key to success in these methods lies in thoroughly researching the platforms and understanding the terms of each lending agreement.

Participating in decentralized finance (DeFi) can also enhance earning potential. DeFi platforms offer a range of services, including yield farming, liquidity provision, and automated trading. These services leverage smart contracts to execute transactions without intermediaries, providing opportunities for passive income. However, DeFi is not without risks. Smart contract vulnerabilities and market fluctuations can impact returns, making it essential to approach these services with caution. Beginners are encouraged to start with low-risk DeFi options and gradually diversify their portfolios as they gain confidence.

Lastly, integrating Bitcoin into everyday transactions can be a practical way to benefit from its utility. Many merchants accept Bitcoin as a form of payment, allowing users to spend their holdings directly. Additionally, Bitcoin can be used to purchase goods and services online, offering convenience for those who prefer digital currencies. However, the value of Bitcoin is subject to exchange rates and transaction fees, requiring careful consideration of cost-effectiveness.

In conclusion, generating income with Bitcoin involves a combination of understanding its mechanics, exploring diverse strategies, and prioritizing security. As the cryptocurrency market evolves, staying informed and adaptable is crucial for long-term success. Whether through long-term holding, trading, staking, or utilizing Bitcoin for daily transactions, the key lies in aligning personal financial goals with risk tolerance. By taking a comprehensive approach and leveraging available resources, newcomers can navigate the complexities of the cryptocurrency world with confidence.