Is Stock Investing Profitable? Decoding the Path to Potential Gains and a Robust Investment System

The allure of the stock market is undeniable. Visions of substantial returns, financial freedom, and early retirement dance in the heads of many. But is stock investing truly profitable? The straightforward answer is: it can be, but profitability is far from guaranteed. It hinges on a multitude of factors, including market conditions, individual stock selection, risk tolerance, and most importantly, a well-defined and diligently executed investment system.

While some perceive the stock market as a high-stakes gamble, successful investors approach it with a disciplined and strategic mindset. They understand that consistent profitability isn't about chasing fleeting trends or relying on gut feelings. It's about understanding the underlying principles, developing a robust system, and sticking to it through market ups and downs. This article will delve into the complexities of stock investing profitability and explore the key components of a complete and effective stock system.

Understanding the Potential and the Pitfalls: Profitability in the Stock Market

The historical performance of the stock market, particularly indices like the S&P 500, provides compelling evidence of its long-term profit potential. Over decades, the market has consistently delivered positive returns, outperforming many other asset classes. However, this long-term perspective obscures the inherent volatility and the possibility of short-term losses.

Several factors contribute to the potential profitability of stock investing:

-

Capital Appreciation: This is the most obvious path to profit – buying a stock at a lower price and selling it at a higher price. This appreciation is driven by factors like company growth, increased profitability, positive industry trends, and overall market sentiment.

-

Dividends: Many companies distribute a portion of their profits to shareholders in the form of dividends. These dividends provide a regular income stream, even if the stock price remains stagnant. Reinvesting dividends can further accelerate returns through compounding.

-

Compounding: This powerful effect allows your earnings to generate further earnings. As your investments grow, the returns they generate also grow, creating a snowball effect over time.

However, it’s crucial to acknowledge the risks involved:

-

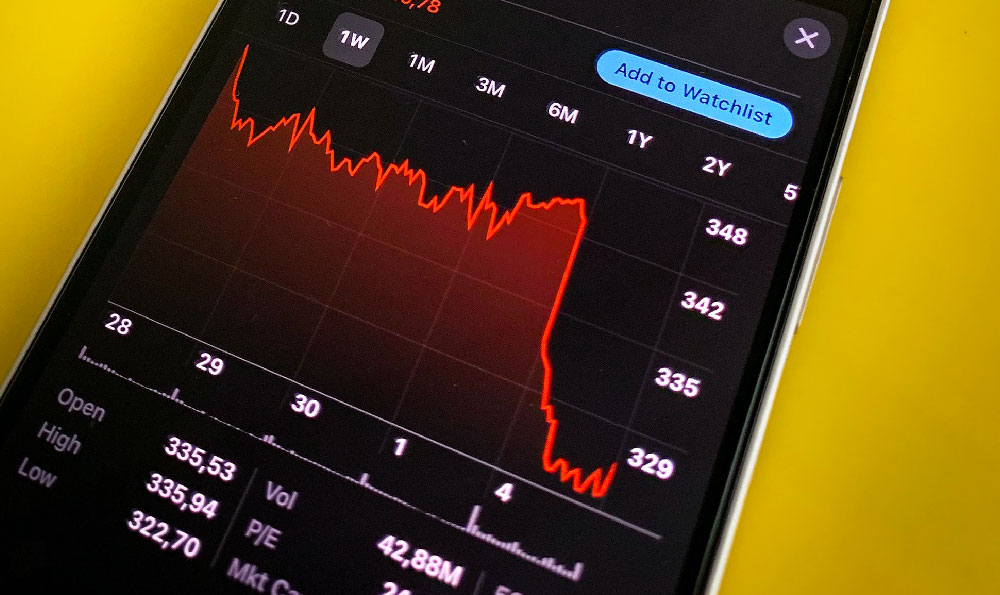

Market Volatility: The stock market is inherently volatile, subject to fluctuations driven by economic news, political events, and investor sentiment. This volatility can lead to short-term losses, even for fundamentally sound companies.

-

Company-Specific Risks: A company's performance can be affected by various factors, including poor management, competition, changing consumer preferences, and regulatory changes. These factors can lead to a decline in the stock price.

-

Economic Downturns: During economic recessions, overall market performance tends to decline, impacting even the best-performing companies.

-

Lack of Knowledge and Discipline: The biggest pitfall for many investors is a lack of knowledge and discipline. Investing without understanding the fundamentals of the market and individual companies is akin to gambling. Similarly, panic selling during market downturns can lock in losses and derail long-term investment goals.

Building a Complete Stock System: A Blueprint for Success

A complete stock system is a comprehensive framework that guides your investment decisions, from initial research to portfolio management. It's not a magic formula, but rather a structured approach that increases your chances of achieving your financial goals. Here are some key components:

1. Define Your Investment Goals and Risk Tolerance

Before investing a single dollar, it's crucial to define your investment goals and understand your risk tolerance. What are you hoping to achieve with your investments? Are you saving for retirement, a down payment on a house, or your children's education? How much risk are you willing to take to achieve those goals?

Your investment goals will determine your investment time horizon and the type of investments you should consider. Your risk tolerance will help you determine the appropriate asset allocation – the mix of stocks, bonds, and other assets in your portfolio.

2. Develop a Research Methodology

Successful stock investing requires thorough research. You need to understand the company's business model, its financial performance, its competitive landscape, and its management team. This involves analyzing financial statements (income statement, balance sheet, cash flow statement), reading industry reports, and staying informed about news and developments related to the company.

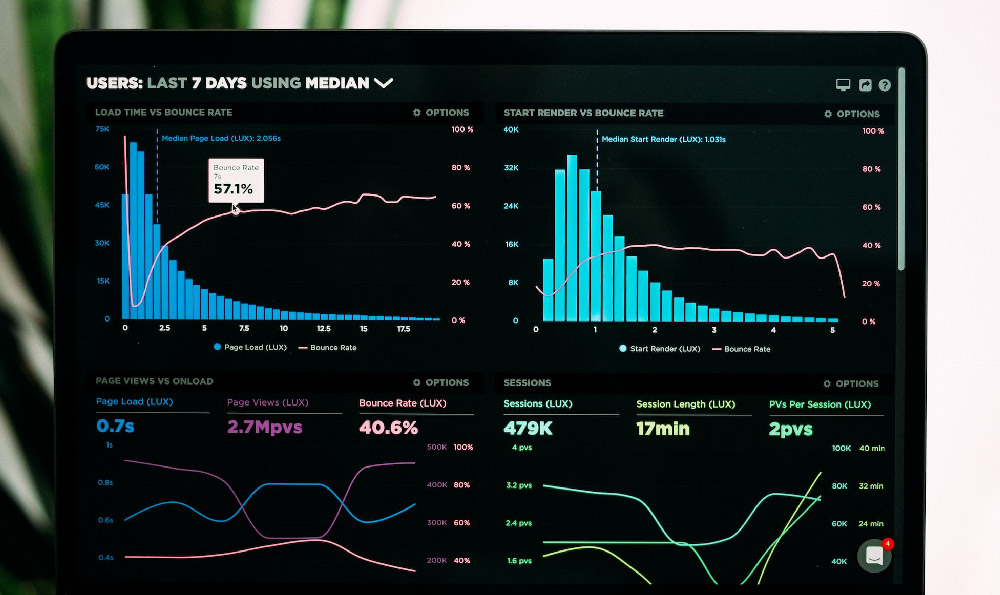

Different investors have different research methodologies. Some focus on fundamental analysis, which involves evaluating a company's intrinsic value based on its financial performance and future prospects. Others focus on technical analysis, which involves analyzing stock price charts and trading volume to identify patterns and predict future price movements. A combination of both fundamental and technical analysis often provides a more comprehensive understanding.

3. Establish Clear Entry and Exit Rules

Once you've identified a stock you want to invest in, you need to establish clear entry and exit rules. What price are you willing to pay for the stock? What criteria will trigger a buy order?

Similarly, you need to establish exit rules. At what price will you sell the stock? Will you set a target price based on your research, or will you use a stop-loss order to limit potential losses? Having clear entry and exit rules helps to remove emotion from your investment decisions and ensures that you stick to your plan.

4. Implement Risk Management Strategies

Risk management is a crucial aspect of any successful stock system. This involves diversifying your portfolio across different sectors and asset classes, setting stop-loss orders to limit potential losses, and periodically rebalancing your portfolio to maintain your desired asset allocation.

Diversification helps to reduce the impact of any single stock or sector on your overall portfolio performance. Stop-loss orders automatically sell a stock if it falls below a certain price, limiting your potential losses. Rebalancing involves selling assets that have outperformed and buying assets that have underperformed to maintain your desired asset allocation.

5. Monitor and Adapt Your System

The stock market is constantly evolving, so your investment system should be adaptable. You need to continuously monitor your portfolio performance, track market trends, and adjust your system as needed. This might involve changing your asset allocation, adjusting your entry and exit rules, or reevaluating your research methodology.

The key is to be flexible and willing to learn from your mistakes. No investment system is perfect, and you will inevitably experience losses along the way. The ability to adapt and learn from your experiences is what separates successful investors from those who consistently underperform.

Conclusion: Investing in a System, Investing in Your Future

Is stock investing profitable? The answer is a resounding "potentially," but the journey to profitability requires dedication, discipline, and a well-defined investment system. By understanding the risks involved, developing a robust research methodology, establishing clear entry and exit rules, implementing risk management strategies, and continuously monitoring and adapting your system, you can significantly increase your chances of achieving your financial goals through stock investing. It's not just about picking stocks; it's about investing in a system that works for you. Remember, the stock market rewards those who approach it with a long-term perspective, a disciplined mindset, and a commitment to continuous learning.