In the ever-evolving landscape of financial markets, the year 2023 has emerged as a pivotal moment for investors seeking high-profit opportunities, particularly within the dynamic realm of cryptocurrency. As blockchain technology continues to mature and institutional interest in digital assets grows, the investment landscape is reshaping itself. Those who approach this field with a clear understanding of market dynamics, technical indicators, and risk management principles are more likely to navigate the complexities successfully. This article explores the strategic potential of cryptocurrency investments in 2023, examines key factors driving market trends, and offers insights into how to build a resilient portfolio while avoiding common pitfalls.

The foundation of profitable investing lies in recognizing the underlying drivers of value. In 2023, the convergence of decentralized finance (DeFi) innovations, non-fungible tokens (NFTs) and metaverse developments, and the increasing institutional adoption of cryptocurrencies has created a unique confluence of opportunities. For instance, the integration of blockchain protocols into traditional financial systems has opened avenues for cross-chain bridges and liquidity solutions, sectors that have shown exponential growth. At the same time, the rise of Web3 platforms and the concept of digital ownership has fueled demand for NFT-based assets, such as virtual real estate and digital collectibles. These emerging markets are not only expanding but also becoming more liquid, attracting both retail and institutional investors.

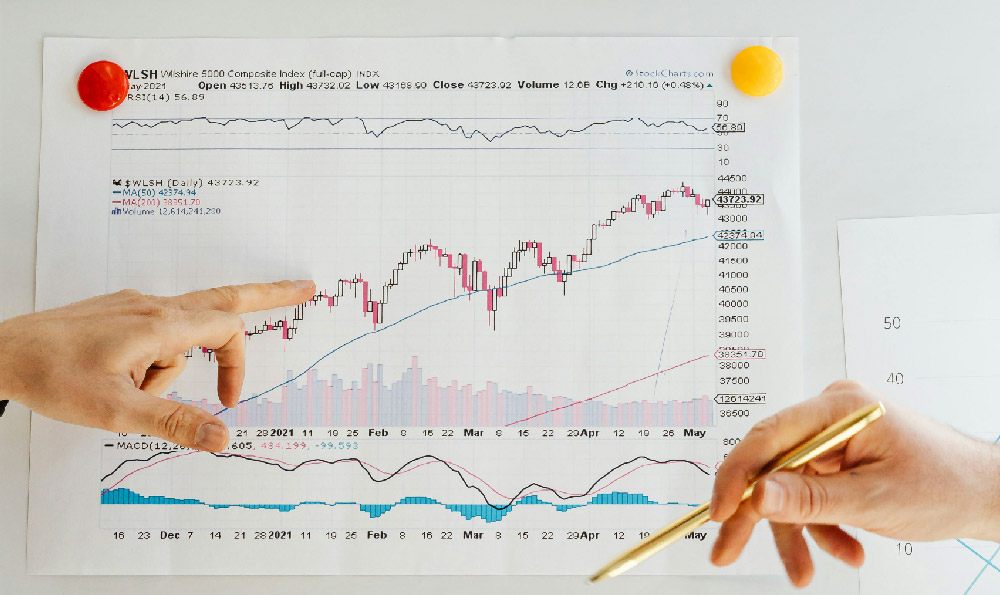

However, the path to profitability is not without challenges. The volatility of cryptocurrency markets means that even the most promising opportunities can experience sudden price swings. This calls for a nuanced approach to technical analysis. Chart patterns such as head and shoulders, ascending triangles, and double bottoms often emerge in the context of crypto price movements, signaling potential entry or exit points. Moving averages, including the 50-day and 200-day lines, can help investors identify trends and gauge whether a particular asset is in a bullish or bearish phase. Additionally, the use of tools like the Relative Strength Index (RSI) and Bollinger Bands allows for a better understanding of market sentiment and potential overbought or oversold conditions. Integrating these technical indicators with fundamental analysis, such as evaluating the development roadmap of a project or analyzing its community engagement, can provide a more comprehensive view for decision-making.

The role of macroeconomic factors cannot be overstated. In 2023, the Federal Reserve's interest rate decisions, the pace of global economic recovery, and geopolitical tensions have all impacted cryptocurrency markets. For example, rising inflation rates and the push for alternative assets have driven increased demand for cryptocurrencies as a hedge against traditional currency devaluation. Conversely, regulatory actions, such as bans on crypto trading in certain regions or the introduction of stricter compliance measures, have introduced uncertainty. Investors who can anticipate these macroeconomic shifts and adapt their strategies accordingly are better positioned to capitalize on opportunities while mitigating risks.

Another critical aspect is diversification. While some investors may be tempted to focus on high-profile projects like Bitcoin or Ethereum, a well-balanced portfolio should include a mix of assets with varying risk profiles. This includes altcoins with strong fundamentals, stablecoins for risk management, and even tokens tied to specific industries such as DeFi or AI. Diversification not only reduces exposure to the volatility of individual assets but also ensures that an investor's portfolio can weather market downturns without significant losses. It is also essential to consider the liquidity of each asset, as highly illiquid tokens can pose challenges during periods of market stress.

In 2023, the rise of decentralized applications (dApps) and the growth of the metaverse have created new investment avenues. Specific sectors such as blockchain gaming, virtual commerce, and AI-driven analytics platforms have demonstrated considerable potential. For instance, the integration of blockchain technology into gaming ecosystems has opened opportunities for play-to-earn models, where users can earn cryptocurrency through gameplay. Meanwhile, the metaverse's expansion has introduced demand for virtual real estate and digital assets that can be traded across decentralized marketplaces. These niches require careful evaluation, as they are often characterized by high potential but also significant risk.

The importance of continuous learning and adaptability cannot be ignored. The cryptocurrency market is highly competitive, and staying updated on the latest technological advancements, regulatory changes, and market trends is essential. Investors who can attend virtual seminars, engage with expert communities, and monitor real-time data are better equipped to make informed decisions. Furthermore, the ability to adapt to shifting paradigms, such as the increasing role of central bank digital currencies (CBDCs) or the evolution of blockchain scalability solutions like layer-2 networks, can distinguish successful investors from the rest.

Success in 2023 hinges on a combination of strategic foresight, disciplined execution, and a deep understanding of the technology that powers these assets. As the crypto market continues to evolve, those who invest with a long-term vision, while maintaining a balance between risk and reward, are more likely to achieve sustainable returns. It's crucial to remember that while the potential for high profit exists, it is paired with the need for rigorous analysis and prudent management. By approaching investments with a calm and calculated mindset, investors can navigate the complexities of the market and position themselves for long-term growth.