Okay, I understand. Here's an article based on the prompt, focused on fast ways to make money, aimed at providing informative and responsible guidance, exceeding 800 words and written in English:

The allure of quick money is undeniable. We all dream of that windfall, that shortcut to financial freedom. However, the reality is that "get rich quick" schemes are often precisely that: schemes. They promise exorbitant returns with little to no effort, and they almost always end in disappointment and financial loss. Instead of chasing fantasies, let's explore realistic, albeit perhaps less glamorous, avenues for generating income quickly, while acknowledging the inherent risks and required effort.

First and foremost, it's crucial to define "fast." What constitutes "quick" for one person might be agonizingly slow for another. If you're facing an immediate financial crisis, your options are significantly different than if you're simply looking to supplement your income or save for a specific goal. This clarity is key to making informed decisions.

For those in immediate need, options like selling unwanted belongings are often the most straightforward. Platforms like eBay, Craigslist, Facebook Marketplace, and dedicated resale apps offer a wide audience for your goods. Properly pricing items, taking clear photos, and writing detailed descriptions can significantly improve your chances of a sale. Remember to factor in shipping costs and potential fees when setting prices. Local pawn shops or consignment stores can also provide quick cash, but be prepared to receive significantly less than the item's true value.

Another immediate option, albeit one to approach with caution, is taking on short-term, gig-based work. Many online platforms connect individuals with temporary jobs, such as food delivery (DoorDash, Uber Eats), ride-sharing (Uber, Lyft), or task completion (TaskRabbit). These gigs offer flexibility, allowing you to work when you have time, but the pay can be unpredictable, and you'll need to factor in expenses like fuel, vehicle maintenance, and self-employment taxes. Furthermore, intense competition can drive down earnings during peak hours.

For those with specific skills, freelancing offers a more sustainable path to faster income generation. Platforms like Upwork, Fiverr, and Guru connect freelancers with clients seeking services like writing, editing, graphic design, web development, virtual assistance, and more. Building a strong profile, showcasing your skills, and actively bidding on projects are essential for securing work. While it may take time to establish a reputation and build a consistent client base, freelancing offers the potential for higher earnings than many gig-based options.

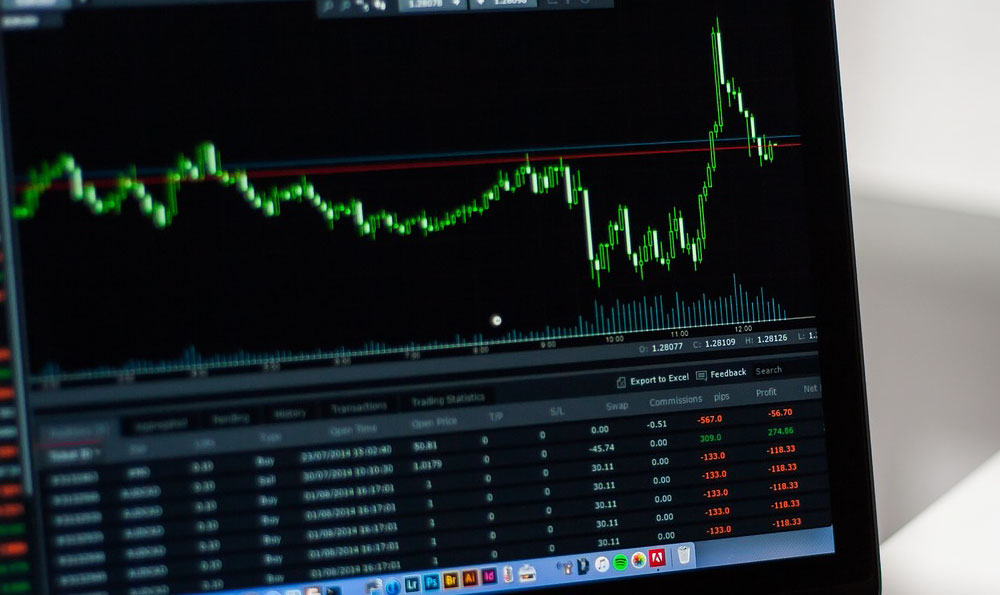

Moving beyond immediate needs, investing can be a path to potentially faster returns, but it also carries inherent risks. Day trading, for example, involves buying and selling securities within the same day, aiming to profit from small price fluctuations. While the potential for rapid gains exists, it's a highly speculative and demanding activity that requires significant knowledge, discipline, and risk tolerance. The vast majority of day traders lose money, highlighting the importance of thorough research and a solid understanding of market dynamics before engaging in this strategy. Consider using a demo account to practice and refine your skills before risking real capital.

Another avenue, often touted for quick gains, is investing in cryptocurrencies or meme stocks. While some individuals have indeed made substantial profits from these assets, they are notoriously volatile and unpredictable. The value of these assets can plummet just as quickly as it rises, leading to significant losses. Investing in cryptocurrencies or meme stocks should only be done with money you can afford to lose, and after conducting thorough research and understanding the underlying technology and market dynamics. Diversification is crucial; never put all your eggs in one basket.

Beyond purely financial strategies, consider developing or monetizing existing skills. Online courses, tutorials, and ebooks can be created and sold on platforms like Udemy, Skillshare, and Teachable. If you possess expertise in a particular area, sharing your knowledge can generate passive income. Similarly, if you have a talent for crafts or creating unique items, platforms like Etsy offer a marketplace to sell your creations.

No matter which path you choose, remember that making money quickly almost always requires hard work, dedication, and a willingness to learn. Avoid schemes that promise guaranteed riches or require upfront investments without offering tangible value. Be wary of hype and unrealistic expectations. Focus on developing valuable skills, providing genuine value to others, and managing your finances responsibly.

Finally, consider the ethical implications of your chosen path. Avoid activities that are illegal, unethical, or exploitative. Building a sustainable income stream based on integrity and value creation will ultimately lead to greater financial security and peace of mind than chasing fleeting opportunities. Building a solid financial foundation often involves patience, discipline, and a long-term perspective. While the pursuit of quick money can be tempting, focusing on building sustainable wealth through sound financial planning and responsible investment is ultimately the wiser course. Remember that consistent effort, combined with smart financial decisions, will yield far greater and more lasting results than any "get rich quick" scheme ever could.