Okay, I understand. Here's an article in English addressing the question of how to get rich fast, acknowledging its complexities and potential pitfalls.

Chasing the Mirage: Unpacking the Dream of Rapid Wealth Accumulation

The allure of instant wealth is a powerful current in the human psyche. We are constantly bombarded with narratives of overnight success stories: the tech startup founder who disrupted an industry, the lucky investor who picked the winning stock, the social media influencer who monetized their personality. These stories fuel the desire to escape the drudgery of a 9-to-5 job and achieve financial freedom, and they naturally lead to the question: How do I get rich fast?

The uncomfortable truth is that the phrase "get rich fast" is often a misnomer, a siren song that leads many individuals towards financial ruin rather than prosperity. While exceptional circumstances and sheer luck can contribute to rapid wealth accumulation, sustainable and ethical wealth building is typically a marathon, not a sprint. It requires discipline, knowledge, strategic planning, and, often, a significant degree of risk tolerance.

Let's dissect some of the approaches frequently associated with the promise of rapid wealth, analyzing their potential and highlighting their inherent risks.

High-Risk Investments: The Allure and the Peril

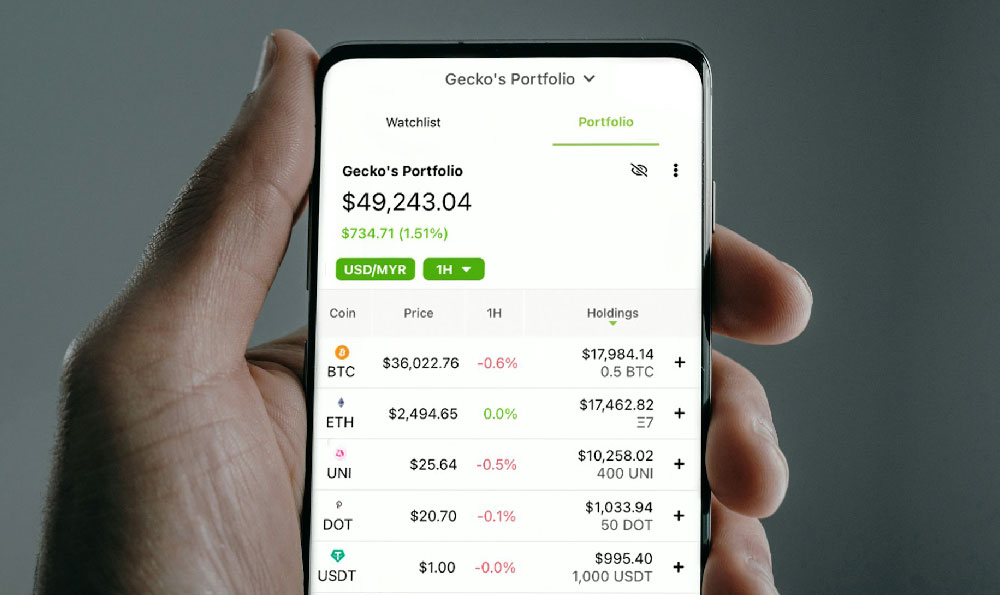

One pathway often touted as a route to rapid riches involves high-risk investments. This can encompass a wide spectrum, from penny stocks and volatile cryptocurrencies to leveraged trading and options trading. The potential rewards are undeniably significant; a well-timed investment in a burgeoning company or a correctly predicted market movement can generate substantial returns in a short period.

However, the "high reward" coin always has a "high risk" flip side. Penny stocks are notorious for their volatility and susceptibility to manipulation. Cryptocurrencies, while offering exciting technological possibilities, are subject to dramatic price swings influenced by factors ranging from regulatory pronouncements to social media trends. Leveraged trading amplifies both potential gains and potential losses, meaning that even a small adverse market movement can wipe out your entire investment. Options trading is complex and requires a deep understanding of market dynamics and risk management principles.

Before venturing into these high-risk arenas, a thorough self-assessment is crucial. Can you afford to lose your entire investment? Do you possess the knowledge and analytical skills necessary to navigate the complexities of these markets? Are you emotionally prepared for the rollercoaster ride of significant gains and potentially devastating losses? Without a resounding "yes" to these questions, approaching high-risk investments as a primary route to rapid wealth is akin to gambling, not investing.

Entrepreneurship: Building a Business from the Ground Up

Starting a business is another avenue that holds the promise of rapid wealth accumulation. The narrative of the scrappy entrepreneur who builds a multi-million dollar empire from humble beginnings is deeply ingrained in our culture. And indeed, entrepreneurship offers the potential for unparalleled financial rewards. If you can identify a market need, develop an innovative product or service, and execute your business plan effectively, the sky's the limit.

However, the path of entrepreneurship is fraught with challenges. The vast majority of startups fail within their first few years. Building a successful business requires an immense amount of hard work, dedication, and resilience. It involves long hours, sleepless nights, and the constant pressure of managing finances, employees, and customer relationships. Moreover, it requires a significant investment of capital, either your own savings or funding secured from investors.

While some entrepreneurs do achieve rapid success, most businesses take years to become profitable. Building a sustainable and scalable enterprise requires a long-term vision and a willingness to adapt to changing market conditions. It also demands strong leadership skills, effective communication, and the ability to build a high-performing team. Therefore, while entrepreneurship can lead to rapid wealth, it is a demanding and high-risk endeavor that requires careful planning and unwavering commitment.

Real Estate: Leveraging Assets and Market Trends

Real estate investment has historically been a reliable wealth-building strategy. In certain market conditions, strategic real estate investments can lead to rapid wealth accumulation. Flipping houses, for example, involves purchasing undervalued properties, renovating them, and selling them for a profit. Investing in emerging neighborhoods with strong growth potential can also generate significant returns over time.

However, real estate is not a guaranteed path to riches. Market fluctuations, unexpected repairs, and tenant issues can all impact profitability. Flipping houses requires significant capital and renovation expertise. Investing in emerging neighborhoods requires careful research and an understanding of local market dynamics. Moreover, real estate is a relatively illiquid asset, meaning that it can be difficult to quickly convert your investment into cash.

Furthermore, the use of leverage (borrowing money to finance real estate purchases) can amplify both potential gains and potential losses. While leverage can increase your return on investment, it also increases your risk. If property values decline or interest rates rise, you could find yourself in a financially precarious situation.

The Importance of Realistic Expectations and Sustainable Strategies

Ultimately, the quest to "get rich fast" is often a distraction from the more important goal of building long-term financial security. While pursuing opportunities for rapid wealth accumulation is not inherently wrong, it is crucial to approach them with realistic expectations and a healthy dose of skepticism.

Instead of focusing solely on the elusive promise of instant riches, consider adopting a more sustainable and balanced approach to wealth building. This might involve:

- Increasing your income: Explore opportunities to advance in your career, start a side hustle, or develop new skills that increase your earning potential.

- Saving diligently: Make saving a priority and automate your savings contributions. Even small amounts saved consistently over time can accumulate into a significant sum.

- Investing wisely: Diversify your investments across a range of asset classes, including stocks, bonds, and real estate. Focus on long-term growth rather than short-term gains.

- Managing your debt: Avoid high-interest debt, such as credit card debt, and prioritize paying down existing debt.

- Continuously learning: Stay informed about financial markets, investment strategies, and personal finance principles.

In conclusion, while the dream of getting rich fast may be appealing, it is important to approach it with caution and a realistic understanding of the risks involved. Building sustainable wealth is a long-term process that requires discipline, knowledge, and a commitment to sound financial principles. Focus on building a strong financial foundation, and you may be surprised at how quickly your wealth accumulates over time. The journey may not be as rapid as you initially hoped, but it will be far more secure and fulfilling.