Investing in the stock market has always been a complex endeavor, requiring diligent research, sharp analytical skills, and a healthy dose of risk management. Now, with the rise of artificial intelligence (AI), a new frontier in stock investing has emerged, promising enhanced decision-making and potentially higher returns. However, integrating AI into your investment strategy isn't without its challenges and concerns. This exploration dives into the best approaches for leveraging AI in stock investing, while critically evaluating the safety and potential pitfalls involved.

Understanding the AI Landscape in Stock Investing

AI in finance isn't a monolithic entity. It encompasses a diverse range of technologies, each offering distinct capabilities. Machine learning (ML) algorithms are at the forefront, capable of analyzing vast datasets of historical stock prices, financial news, and economic indicators to identify patterns and predict future market movements. Natural Language Processing (NLP) helps interpret unstructured data like news articles, social media sentiment, and company reports, providing insights into market sentiment and potential risks. Algorithmic trading systems, powered by AI, can execute trades automatically based on predefined parameters, aiming to capitalize on fleeting opportunities.

Best Approaches to Incorporating AI into Your Investment Strategy

Several avenues exist for incorporating AI into your stock market journey. The optimal approach depends on your investment goals, risk tolerance, and level of technical expertise.

-

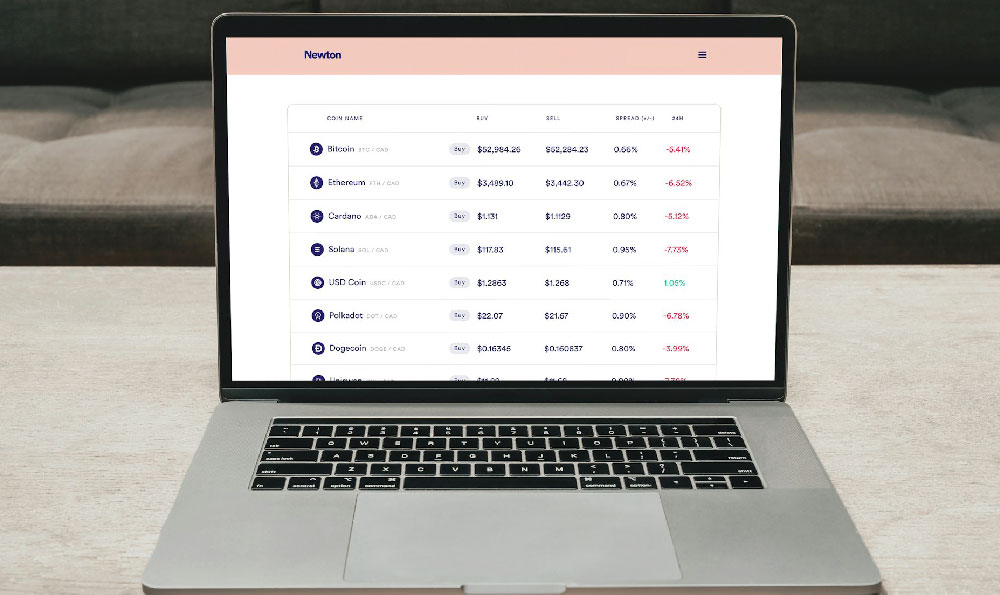

AI-Powered Investment Platforms: These platforms offer a user-friendly interface to access AI-driven investment tools. They typically provide features like automated portfolio construction, robo-advisory services, and AI-driven stock recommendations. While convenient, it's crucial to carefully evaluate the platform's underlying methodology, performance track record, and associated fees. Look for transparency in how the AI algorithms are trained and validated.

-

Utilizing AI-Driven Analytical Tools: If you prefer a more hands-on approach, consider using AI-powered analytical tools to supplement your own research. These tools can provide valuable insights into stock valuations, financial statement analysis, and risk assessment. They can help you identify potential investment opportunities that might be missed through traditional methods. Examples include platforms that offer sentiment analysis of news or social media, or those that predict earnings surprises based on alternative data.

-

Developing Your Own AI Models (Advanced): For those with strong programming and data science skills, building your own AI models for stock prediction can be a rewarding, albeit challenging, endeavor. This requires access to high-quality data, expertise in machine learning algorithms, and a thorough understanding of financial markets. Be prepared to invest significant time and resources in data cleaning, model training, and rigorous backtesting.

-

Hybrid Approach: Combining AI with Human Expertise: The most prudent approach often involves a hybrid model that leverages AI's analytical power while retaining human oversight and judgment. AI can identify potential investment opportunities, but ultimately, the decision to invest should be based on your own assessment of the risks and rewards, considering factors that AI might not capture, such as qualitative aspects of a company's management or competitive landscape.

Assessing the Safety and Risks of AI in Stock Investing

While AI offers significant potential, it's essential to acknowledge the inherent risks and limitations.

-

Data Dependency: AI models are only as good as the data they are trained on. If the data is biased, incomplete, or outdated, the model's predictions will be flawed. Historical data may not always be indicative of future performance, especially in rapidly changing market conditions.

-

Overfitting: AI models can sometimes become overly specialized in recognizing patterns in the training data, leading to poor performance on unseen data. This is known as overfitting, and it's a common pitfall in machine learning.

-

Lack of Transparency: Some AI algorithms, particularly deep learning models, can be "black boxes," making it difficult to understand how they arrive at their predictions. This lack of transparency can make it challenging to assess the model's reliability and identify potential biases.

-

Market Volatility: AI models may struggle to adapt to sudden market shifts or unexpected events. During periods of high volatility, their predictions may become less accurate, leading to losses.

-

Cybersecurity Risks: AI-powered investment platforms and tools are vulnerable to cyberattacks, which could compromise sensitive data or disrupt trading operations.

Mitigating Risks and Enhancing Safety

Several strategies can help mitigate the risks associated with AI in stock investing:

-

Diversification: Don't rely solely on AI-driven recommendations. Diversify your portfolio across different asset classes and investment strategies.

-

Due Diligence: Thoroughly research any AI-powered investment platform or tool before using it. Understand its methodology, track record, and associated fees.

-

Risk Management: Set clear risk management parameters and stick to them. Use stop-loss orders to limit potential losses.

-

Continuous Monitoring: Regularly monitor the performance of your AI-driven investments and adjust your strategy as needed.

-

Human Oversight: Always retain human oversight and judgment. Don't blindly trust AI recommendations without considering your own assessment of the risks and rewards.

-

Stay Informed: Keep abreast of the latest developments in AI and finance. Understand the limitations of AI and be aware of potential biases.

Conclusion

AI has the potential to revolutionize stock investing, offering enhanced decision-making and potentially higher returns. However, it's crucial to approach AI with a critical and informed perspective. By understanding the different approaches to incorporating AI, acknowledging the inherent risks, and implementing appropriate risk mitigation strategies, investors can harness the power of AI while protecting their capital. The future of stock investing likely involves a synergistic blend of AI's analytical prowess and human expertise, creating a more efficient and informed investment landscape. Remember, AI is a tool, not a replacement for sound investment principles and disciplined risk management.