The allure of making money online quickly and easily is undeniable. It's plastered across social media, whispered in online forums, and promised in countless get-rich-quick schemes. While the internet undoubtedly offers avenues for financial gain, the reality is often far more nuanced and requires a healthy dose of skepticism, diligent research, and realistic expectations, especially when it comes to the volatile world of virtual currencies.

Let's dissect the core premise: is making money online genuinely fast and easy? The answer is a resounding "it depends." It depends on your existing skillset, your willingness to learn, the capital you're prepared to invest, and your risk tolerance. More importantly, it depends on choosing legitimate and sustainable methods over fleeting trends and outright scams.

Many online opportunities advertise seemingly effortless paths to wealth. These often involve minimal effort, requiring you to click links, complete surveys, or participate in referral programs. While these activities might generate small amounts of pocket money, they rarely translate into significant income. In fact, these platforms are often designed to profit from your time and data, offering minimal compensation in return. Think of them as digital "penny-pinching" ventures.

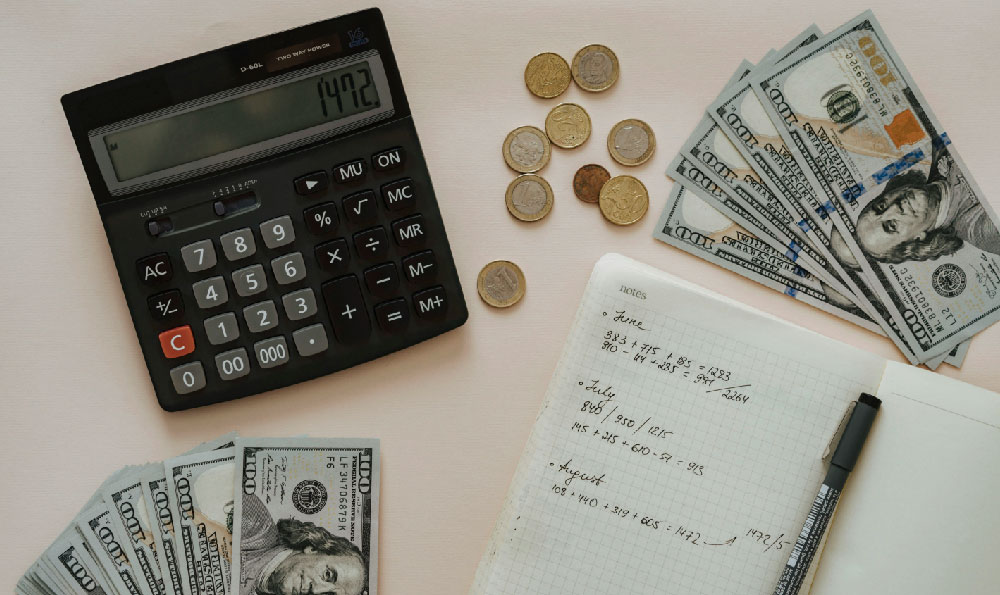

Now, let's transition to the more intriguing and potentially lucrative, but also significantly riskier, realm of virtual currency investments. The decentralized nature of cryptocurrencies, combined with their potential for exponential growth, has attracted a wave of investors, both experienced and novice. The stories of individuals striking it rich overnight fuel the perception that virtual currency investing is a fast and easy path to wealth. However, this perception is often dangerously misleading.

The reality of virtual currency investing is far more complex than simply buying low and selling high. The market is notoriously volatile, susceptible to sudden price swings triggered by regulatory announcements, technological advancements, social media hype, and even simple market sentiment. What appears as a promising upward trend can quickly reverse, wiping out significant portions of your investment in a matter of hours.

To navigate this volatile landscape effectively, you need to arm yourself with knowledge. Begin by understanding the underlying technology behind cryptocurrencies, particularly blockchain. Familiarize yourself with different types of virtual currencies, their use cases, and their associated risks. Research the teams behind specific projects, their white papers, and their community involvement. This foundational knowledge will help you differentiate between promising projects with real potential and speculative bubbles destined to burst.

Technical analysis is another crucial skill for virtual currency investors. Learning to interpret charts, identify trends, and use technical indicators can provide valuable insights into market movements. Understanding concepts like support and resistance levels, moving averages, and relative strength index (RSI) can help you make more informed trading decisions. However, remember that technical analysis is not foolproof, and past performance is not indicative of future results.

Beyond technical skills, a crucial aspect of successful virtual currency investing is risk management. Never invest more than you can afford to lose. Diversify your portfolio across different virtual currencies to mitigate the risk of any single asset performing poorly. Set stop-loss orders to automatically sell your assets if they fall below a certain price, limiting potential losses. Resist the urge to FOMO (fear of missing out) and chase after hyped-up coins without conducting thorough research.

Furthermore, be wary of "get-rich-quick" schemes and promises of guaranteed returns. These are often hallmarks of scams designed to exploit unsuspecting investors. Never invest in projects that are shrouded in secrecy or lack transparency. Research the team behind the project, their track record, and their community involvement. If something sounds too good to be true, it probably is.

Protecting your virtual currency holdings is also paramount. Use strong, unique passwords for all your online accounts. Enable two-factor authentication (2FA) whenever possible to add an extra layer of security. Store your virtual currencies in secure wallets, such as hardware wallets, which are less vulnerable to hacking than online exchanges. Be cautious of phishing scams and never share your private keys or seed phrases with anyone.

In conclusion, while the internet offers potential avenues for making money, the idea of "fast and easy" should be approached with caution. Virtual currency investing, in particular, requires a significant investment of time, effort, and resources to be successful. It's not a get-rich-quick scheme, but a high-risk, high-reward opportunity that demands a disciplined approach, continuous learning, and a unwavering commitment to risk management. By educating yourself, diversifying your portfolio, and protecting your assets, you can increase your chances of success in the exciting, yet challenging, world of virtual currencies. Remember, the key to long-term financial growth is not speed, but strategy, knowledge, and a patient, calculated approach.