When the uncertainties of unemployment cast a shadow over your financial stability, the instinct to seek income becomes not just a necessity but an opportunity to explore new horizons. The modern economy offers a tapestry of alternatives that extend beyond traditional employment, and understanding how to navigate these can transform a period of disruption into a catalyst for growth. The key lies in identifying a strategy that aligns with your existing skills, passions, and available time, while also considering the risk-return balance crucial to long-term financial health.

One of the most accessible pathways for generating income during unemployment is leveraging your existing skillset through freelance work. Platforms like Upwork, Fiverr, or Toptal provide a marketplace where individuals can offer services ranging from graphic design and writing to programming and consulting. This model allows you to maintain a sense of purpose and autonomy while earning money from the comfort of your home. However, it's essential to recognize that the freelance market is competitive and subject to fluctuating demand. Success here requires not just a strong portfolio but also the ability to continuously improve and adapt, perhaps by investing in short courses or certifications that enhance your marketability. The beauty of this approach is its scalability; as your reputation grows, so can your rates and the volume of projects you undertake.

Content creation has emerged as a powerful tool for generating passive income, particularly in the digital age. Whether it's through YouTube, TikTok, blogging, or podcasting, the ability to monetize your creative output can provide a steady cash flow. For instance, creating educational videos on financial literacy or sharing insights on market trends can attract a niche audience willing to support your work through advertisements, sponsorships, or affiliate marketing. The initial phase often demands significant time and effort to build an audience, but the rewards can be substantial. It's a long-term investment in your personal brand, though the income may not be immediate. The challenge here is to maintain consistency and quality, which requires discipline and a clear plan for content strategy.

The gig economy has also opened doors to diverse work opportunities that align with modern lifestyles. From delivery services like Uber Eats or DoorDash to remote tasks on platforms like TaskRabbit or Swagbucks, these options allow you to earn on your own terms. The appeal of such work is the flexibility it offers, enabling you to balance multiple income streams or dedicate time to other pursuits. However, the income from these gigs is often not guaranteed and may fluctuate based on market demand and availability. It's important to approach these opportunities with a mindset of experimentation, testing different platforms and roles to find what suits your interests and schedule best.

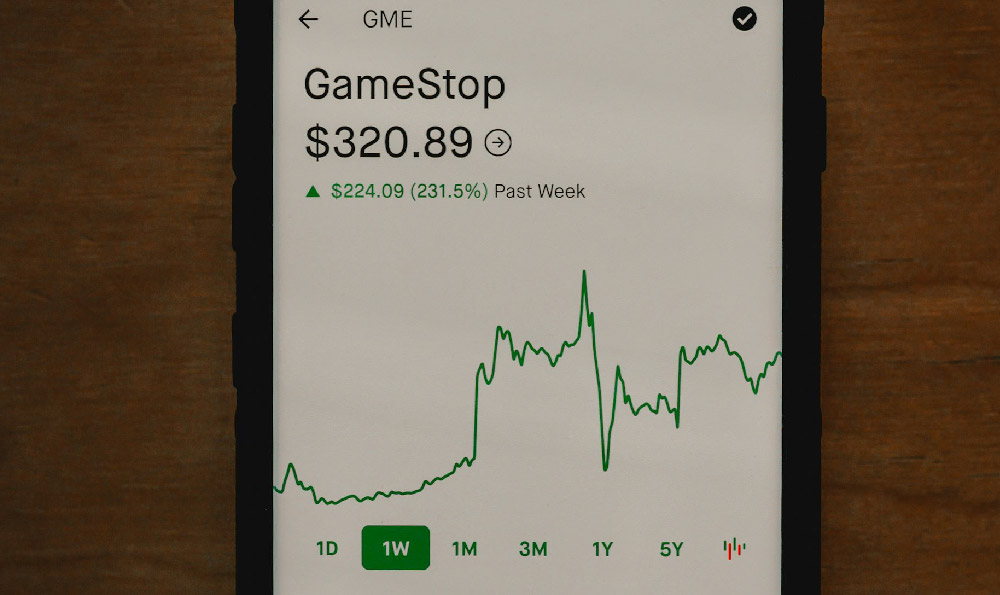

Passive income streams represent an often-overlooked avenue for financial stability, especially when unemployment is prolonged. These include investments in stocks, bonds, or real estate, as well as rental income from property or digital assets like websites or domains. While such methods can provide regular returns, they require careful consideration of risk factors. For example, investing in the stock market without a solid understanding of fundamentals can lead to losses, whereas renting out property involves upfront costs and ongoing management. The key is to diversify your approach, perhaps by starting with low-risk options like dividend-paying stocks or REITs (Real Estate Investment Trusts), which offer steady income with minimal active involvement.

Another angle to consider is the monetization of your personal brand or online presence. If you have a hobby, expertise, or unique perspective, transforming it into a monetizable asset can yield significant returns. This might involve creating an online store for handmade products, offering downloadable resources like templates or guides, or providing digital services like online courses or consulting. The success of these ventures depends heavily on your ability to connect with your audience and deliver value consistently. It's a process that requires patience, as building a loyal customer base takes time.

The opportunity to monetize your time and skills extends beyond the digital realm. For instance, offering tutoring services in areas where you have expertise, such as finance, programming, or languages, can provide a steady income. Similarly, participating in crowdsourcing or affiliate marketing programs allows you to earn commissions by promoting products or services you genuinely believe in. These methods may require some initial effort in setting up your platform or optimizing your strategy, but they offer the potential for long-term gains.

In addition to generating income, it's crucial to view this period as a chance for self-improvement. Investing in your personal development, whether through education, certifications, or learning new technologies, can enhance your employability and open doors to better opportunities in the future. This aligns with the principle that short-term financial gains should not come at the expense of long-term growth. Furthermore, the skills acquired during this time can prove invaluable when the job market stabilizes.

The modern financial landscape is shaped by continuous technological and economic changes, making it essential to stay informed and adaptable. Keeping abreast of market trends, technological innovations, and emerging industries can help you identify opportunities that align with your interests and capabilities. For example, the rise of remote work has created demand for virtual assistants, whereas the growth of e-commerce has opened avenues for dropshipping or affiliate marketing. Understanding these trends allows you to make informed decisions about where to direct your efforts.

Ultimately, the path to generating income during unemployment is not a one-size-fits-all solution. It requires a tailored approach that considers your personal circumstances, skills, and financial goals. By exploring a mix of active and passive income streams, experimenting with new ideas, and focusing on continuous improvement, you can build a resilient financial foundation. The journey may not be easy, but with persistence and strategic planning, it's possible to transform a challenging period into an opportunity for growth and financial security.